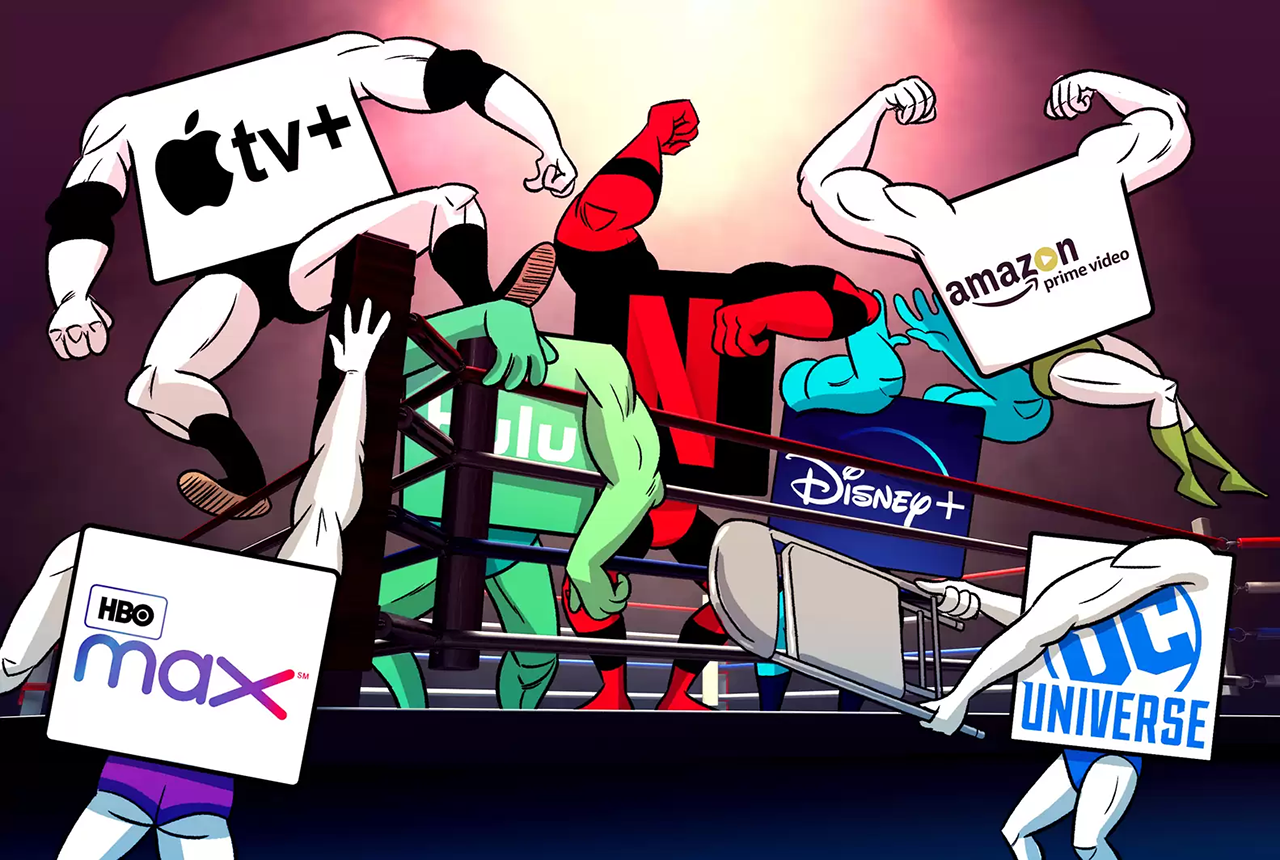

The evolution of the Streaming Wars, from Netflix's early dominance to the crowded battlefield of today's media landscape.

Introduction: The Global Battle in Your Living Room

A quiet revolution has fundamentally altered one of the most universal human rituals: watching television. The era of appointment viewing, dictated by network schedules, has been usurped by the age of on-demand everything. This shift has ignited the Streaming Wars—a high-stakes, multi-billion dollar global conflict where media titans and tech giants vie for supremacy in the most valuable real estate of the 21st century: your attention. This battle is not just about which service you subscribe to; it’s a reshaping of culture and society, influencing what stories are told, how they are consumed, and the very economics of media and entertainment.

Why does this matter now? Because we are moving past the initial growth frenzy and into a volatile phase of consolidation, strategy shifts, and market saturation. Understanding the Streaming Wars is key to understanding the future of narrative art, the fate of legacy media companies, and the financial and psychological impact of “subscription fatigue” on consumers worldwide.

Background/Context: From Cable Bundles to A La Carte Streams

The Streaming Wars did not emerge from a vacuum. They are the direct result of technological advancement and consumer frustration.

- The Cable Era: For decades, consumers paid for expensive, bloated cable bundles, subsidizing hundreds of channels they never watched to access the few they loved.

- The Disruptor: Netflix: Starting as a DVD-by-mail service, Netflix pioneered streaming as a convenient, affordable, and commercial-free alternative. Its early strategy was to license content from studios, who were happy to sell their “old” shows for easy revenue.

- The Studios Awaken: Around 2017-2019, studios realized they were funding their own disruptor. The value of their content libraries became apparent, and they began reclaiming their IP (like Disney pulling its content from Netflix) to launch their own direct-to-consumer services. The war was officially declared.

Key Concepts Defined

- Streaming Wars: The intense competition between video-on-demand services for market share, subscribers, and exclusive content.

- SVOD (Subscription Video on Demand): Services funded primarily by a monthly subscription fee (e.g., Netflix, Disney+).

- AVOD (Advertising-Based Video on Demand): Free or cheaper services funded by advertisements (e.g., YouTube, Freevee, Pluto TV).

- Cord-Cutting: The trend of consumers canceling traditional cable or satellite TV subscriptions in favor of streaming services.

- Original Programming: Exclusive content produced or commissioned by a streaming service to differentiate itself and attract subscribers (e.g., Stranger Things, The Mandalorian).

- Content Library: The back catalog of licensed or owned movies and TV shows available on a service.

How It Works: The Battlefield Strategies (A Step-by-Step Analysis)

The conflict is fought on several strategic fronts simultaneously.

Step 1: The Land Grab – Subscriber Acquisition

The initial phase was a race to amass as many global subscribers as possible, often by subsidizing cost and spending heavily on marketing. Deep-pocketed players like Apple and Amazon could afford to lose money for years to build a user base.

Step 2: The Arsenal – Content is the Weapon

Services differentiate themselves through their content arsenal. This happens in two ways:

- Legacy Library: Leveraging a vast, beloved back catalog (Disney’s animated classics, HBO’s prestige dramas, Paramount’s Star Trek).

- Original “Tentpole” Content: Investing billions in must-watch exclusive shows and movies to create “event” viewing and justify the subscription.

Step 3: The Battlefield – Technology and User Experience (UX)

A service must be reliable, easy to use, and personalized. Key factors include:

- Algorithmic Recommendation: Sophisticated AIs that keep users engaged by suggesting the next show to binge.

- Streaming Quality: 4K, HDR, and Dolby Atmos support are becoming standard for high-tier plans.

- Interface Design: A cluttered or confusing app can drive users to a competitor.

Step 4: The Logistics – Pricing and Packaging

This is where the global supply chain management of digital infrastructure meets consumer strategy. Services experiment with:

- Tiered Pricing: Offering a basic plan with ads, a standard plan, and a premium plan with the best quality.

- Bundling: Partnering with other services (e.g., Disney Bundle with Hulu and ESPN+) or mobile carriers to add value.

Step 5: The New Front – Global Expansion

With the local US market saturated, the battle has moved to international territories, requiring massive investments in local content production (e.g., Netflix’s Squid Game from Korea, Money Heist from Spain).

Why It’s Important: The Cultural and Economic Ripple Effects

The Streaming Wars have consequences far beyond your monthly bill.

- The End of the Shared Cultural Experience: The era of “water-cooler TV,” where everyone watched the same show at the same time, is fading. We now have hyper-specialized niches, fragmenting our common cultural ground.

- The Data-ification of Creativity: Green-lighting decisions are increasingly driven by algorithmically identified “taste clusters” and completion rate data, potentially homogenizing creative risks.

- Revival and Cancellation Whiplash: The need for a constant stream of content has led to the revival of beloved canceled shows, but it has also created an environment where new shows are canceled abruptly if they don’t immediately capture a massive audience.

- The Gold Rush for Talent: Creators and stars are commanding unprecedented prices, but often in exchange for their work being siloed on a single platform. For insights on navigating such high-stakes careers, our guide on mental health is a vital resource.

- The Great Content Archive: For consumers, it’s a golden age of access. Vast swathes of film and television history, once lost to time, are now available on-demand.

Common Misconceptions and Public Observations

- Misconception: “Netflix is doomed.”

Reality: While facing intense competition, Netflix remains the global leader with a massive content budget, strong brand recognition, and a head start in technology and worldwide distribution. - Observation: “There are too many services; I’ll just go back to cable.”

Reality: The flexibility and lack of contracts still make a curated bundle of 2-3 streaming services cheaper and more convenient than cable for most people. - Misconception: “The best service is the one with the most content.”

Reality: Quality and personal taste trump quantity. A smaller, well-curated library that aligns with your interests (e.g., Criterion Channel for cinephiles) can offer more value than a vast, unfocused one. - Observation: “All this content is unsustainable.”

Reality: It is. The current level of spending is a war of attrition. The market is already correcting, with services raising prices, introducing ad-tiers, and cutting back on marginal projects. - Misconception: “The player with the best content wins.”

Reality: The player with the most sustainable business model wins. Content is the weapon, but profitability is the victory condition.

Recent Developments, Case Studies, and Success Stories

1. The Pivot to Advertising: After years of touting an ad-free experience, nearly every major player (Netflix, Disney+) has launched a cheaper, ad-supported tier. This opens a new, massive revenue stream and attracts price-sensitive consumers, a strategy well-understood in modern ecommerce and digital marketing.

2. The “Great Re-bundling”: Companies are now exploring re-bundling services to simplify the user experience and reduce churn. The Disney Bundle (Disney+, Hulu, ESPN+) is the prime example. This mirrors the cable bundle but with more consumer choice.

3. The Max Success Story:

The merger of Discovery+ and HBO Max to form “Max” is a fascinating case study in strategic consolidation.

- Methodology: Combine Warner Bros.’s prestige, scripted content (HBO, DC) with Discovery’s massive library of low-cost, highly engaging unscripted reality TV (HGTV, Food Network).

- Success Story: The goal was to create a service with “something for everyone,” reducing subscriber churn. A user might subscribe for The Last of Us but stay because their entire family finds value in the vast reality TV library, making the subscription “sticky.”

4. The Global Breakout: Squid Game:

Netflix’s Korean thriller became a global phenomenon virtually overnight. This demonstrated the power of a platform to elevate local content to worldwide status and proved that language is no longer a barrier to global success, fundamentally changing content investment strategies.

Real-Life Examples and Information Sources

- The Disney+ Launch: A masterclass in leveraging iconic IP (Marvel, Star Wars, Pixar) to amass over 100 million subscribers in just 16 months.

- Apple TV+ Strategy: Focuses on a small number of high-quality, prestige “tentpole” shows (Ted Lasso, The Morning Show) to drive brand association with quality rather than quantity.

- The Demise of CNN+: A cautionary tale of launching a niche service without a clear market fit or a large content library, leading to its shutdown just one month after launch.

- The Rise of FAST: Free Ad-Supported Streaming TV (Pluto TV, Tubi) is growing rapidly, capturing the budget-conscious “cord-never” audience and proving the AVOD model’s viability, a topic often covered on digital business hubs like World Class Blogs.

Sustainability Framework for the Streaming Ecosystem

The current state of the Streaming Wars is financially and creatively unsustainable. A framework for long-term viability is emerging.

- Profitability over Growth: The market is shifting focus from subscriber growth at any cost to a path to profitability. This means price hikes, password-sharing crackdowns, and more disciplined content spending.

- Content Portfolio Diversification: A sustainable service cannot rely only on $200 million blockbusters. A mix of big-budget tentpoles, mid-budget genre fare, and low-cost unscripted/reality content creates a balanced and resilient content slate.

- Hybrid Monetization Models: Relying solely on SVOD is risky. The future is hybrid SVOD/AVOD models, allowing services to capture revenue from both subscription-averse and ad-tolerant audiences.

- Strategic Consolidation: Further mergers and acquisitions are inevitable. It is unsustainable for 7-8 major services to all operate profitably. We will see more mergers like Discovery-Warner.

- Global Localization: True global success requires being a local hero in many countries. Investing in regional production isn’t just an option; it’s a necessity for growth and relevance.

Conclusion & Key Takeaways

The Streaming Wars have permanently transformed our media landscape. The dust is far from settled, but the initial chaotic land grab is giving way to a more mature, complex, and challenging phase focused on sustainable business models.

Key Takeaways:

- The consumer has unprecedented choice and control, but this has led to fragmentation and subscription fatigue.

- Content is king, but profitability is emperor. The era of limitless spending is over.

- The future will be defined by bundles, hybrid ad/subscription models, and strategic consolidation.

- Global and local content is now as important as Hollywood blockbusters for attracting a worldwide audience.

- The ultimate winner may not be a single service, but a small roster of giants who successfully navigate this transition to sustainability.

The evolution of media is a core component of modern culture and society. To explore more analyses on how technology is changing our world, visit our main blog page.

Frequently Asked Questions (FAQs)

- Who are the main players in the Streaming Wars?

The major players are Netflix, Amazon Prime Video, Disney+, Max, Paramount+, Peacock, Apple TV+, and Hulu. - What does “cord-cutting” mean?

Canceling a traditional pay-TV service (cable or satellite) and using internet-based streaming services instead. - Which streaming service has the best content?

It’s entirely subjective and depends on your taste. Netflix has volume and variety, Disney+ has family and franchise IP, HBO Max has prestige, etc. - Are streaming services profitable?

As of 2024, only Netflix and Amazon Prime Video are consistently profitable in their streaming divisions. Others are still investing heavily to grow. - What is the difference between SVOD and AVOD?

SVOD is paid for by a subscription (Netflix). AVOD is free and supported by ads (Pluto TV). Many services now offer both (e.g., Netflix with Ads, Disney+ with Ads). - Why is everyone cracking down on password sharing?

To convert “freeloading” viewers into paying subscribers, a key step toward profitability in a saturated market. - What is “churn” in streaming?

The rate at which subscribers cancel their service. Low churn is critical for stability. - Will there be another “Great Re-bundling”?

Yes, but it will be digital and more flexible than the cable bundle, allowing consumers to pick and choose their preferred bundle of services. - How does original programming benefit a streamer?

It creates exclusive, must-have content that cannot be found anywhere else, driving subscriptions and reducing reliance on licensed content from competitors. - What was the impact of the COVID-19 pandemic on the Streaming Wars?

It massively accelerated subscriber growth and cord-cutting as people were stuck at home, pulling forward growth that might have taken years. - How do streaming services decide what to cancel?

Primarily based on viewership versus cost. A show with a moderate audience but a very high production cost is likely to be canceled. - What is a “FAST” channel?

Free Ad-Supported Streaming Television. They offer linear, scheduled channels of content (like old-school TV) for free with ads (e.g., Pluto TV, The Roku Channel). - Is live sports streaming the next frontier?

Absolutely. Sports are the last bastion of live, appointment television and a major driver for cable subscriptions. Streamers are now bidding aggressively for sports rights. - How can I manage the cost of multiple subscriptions?

Rotate them (subscribe to one or two at a time), share costs with family, or prioritize the ad-supported tiers of services. - What happens to the shows if a streaming service shuts down?

They often disappear into a void, a modern-day “digital decay.” This highlights the risk of not physically owning your favorite media. - Why are streamers producing content in international markets?

To attract subscribers in those regions and to find the next global hit like Squid Game or Money Heist. - What is the biggest challenge for new streaming services?

The immense cost of content creation and marketing required to compete with established players, and the technological hurdle of building a reliable, global platform. - How does Amazon Prime Video’s strategy differ?

For Amazon, Prime Video is a “value-add” to keep users within the Amazon Prime ecosystem, driving e-commerce loyalty rather than being a standalone profit center. - What role does user data play?

It’s crucial. Data on viewing habits informs recommendation algorithms, content creation decisions, and advertising targeting. - Is the theatrical movie window dead?

It’s severely shortened. The 90-day exclusive theatrical window is largely gone, with many studios now releasing films in theaters and on streaming within 45 days or even simultaneously. - What is the future of niche streaming services?

They can be sustainable by catering to a dedicated, passionate audience willing to pay for specialized content (e.g., Shudder for horror, BritBox for British TV). - How do I decide which services to keep?

Audit your viewing habits every 3-6 months. Keep the services you actively use most weeks and cancel the rest, re-subscribing only when a must-watch show returns.