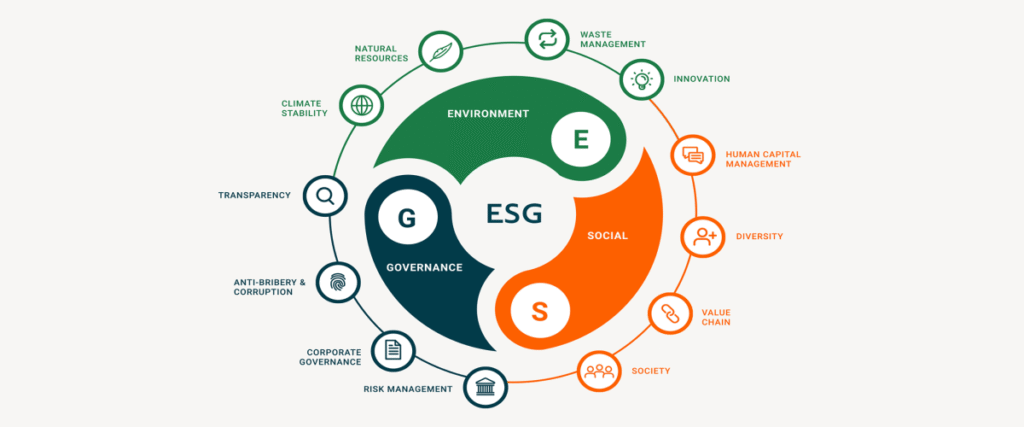

The Three Pillars of ESG: A framework for evaluating a company's commitment to Environmental, Social, and Governance factors.

Introduction: Why ESG is More Than a Buzzword

A quiet revolution is transforming the global business landscape. It’s not driven solely by new technology or market disruption, but by a fundamental shift in how we define value and risk. Trillions of dollars in investment capital are now flowing according to a new set of principles that look beyond traditional financial metrics. This shift is powered by Environment, Social Governance (ESG).

ESG stands for Environmental, Social, and Governance. It is a framework used by investors and stakeholders to evaluate a company’s resilience, ethical impact, and long-term sustainability. For decades, the primary—and often sole—focus was on profit. Today, there is a growing consensus that a company’s performance on environmental, social, and governance issues is a critical indicator of its future financial success.

Understanding ESG is no longer optional for executives, investors, or even employees. It represents a fundamental reorientation from shareholder capitalism—focusing purely on returns for investors—to stakeholder capitalism, which considers the impact on all groups: employees, customers, communities, and the planet. This guide will demystify ESG, cut through the political noise, and provide a clear, actionable understanding of how this framework is reshaping the rules of business and investment. For more clear explanations of complex topics, visit our Explained section.

Background & Context: The Evolution from SRI to ESG

The roots of ESG lie in the older concept of Socially Responsible Investing (SRI). SRI was primarily about values-based exclusion—avoiding investments in “sin stocks” like tobacco, firearms, or gambling based on an investor’s moral or ethical beliefs.

ESG represents a significant evolution from SRI. It is not about exclusion alone; it’s about value-based integration. ESG posits that strong performance on environmental, social, and governance factors is directly correlated with reduced risk and enhanced long-term financial returns. It moves the conversation from “Is this company good?” to “Is this company well-managed for the future?”

The term was first coined in a 2004 UN report, “Who Cares Wins,” which argued that integrating ESG factors into capital markets made good business sense. The catalyst for its mainstream adoption was the rise of millennial and Gen Z investors, increased regulatory pressure, and a series of corporate scandals that highlighted the colossal financial costs of poor governance and environmental negligence. For a perspective on how global systems are evolving, our article on Global Supply Chain Management provides relevant context.

Key Concepts Defined: Deconstructing the E, S, and G

To grasp ESG, you must understand what falls under each pillar.

The E – Environmental

This pillar assesses a company’s impact on the natural world and how it manages environmental risks.

- Climate Change & Carbon Emissions: How does the company contribute to greenhouse gases? What are its targets for reduction (Net Zero)?

- Resource Depletion & Waste Management: How efficiently does it use water, energy, and raw materials? What is its circular economy strategy?

- Pollution & Biodiversity: Does it pollute air, land, or water? How does its operations affect ecosystems?

The S – Social

This focuses on the company’s relationships with its people and the communities where it operates.

- Employee Relations & Diversity: Are working conditions safe and fair? Is there diversity, equity, and inclusion (DEI) in the workforce? How are employee engagement and satisfaction?

- Data Privacy & Security: How does the company protect customer data?

- Community Relations & Human Rights: What is its impact on local communities? Does it ensure human rights are respected throughout its supply chain?

The G – Governance

This is the internal system of practices, controls, and procedures that governs a company. It is the foundation that supports the other two pillars.

- Board Diversity & Structure: Is the board of directors independent and diverse? Are the roles of CEO and Chair separated?

- Executive Compensation: Is pay tied to long-term performance and ESG goals?

- Shareholder Rights & Transparency: Can shareholders vote on key issues? Is the company transparent in its reporting?

- Ethics & Compliance: Does it have robust systems to prevent corruption, bribery, and anti-competitive behavior?

How ESG Works: A Step-by-Step Guide to Implementation and Analysis

Implementing and analyzing ESG is a structured process. Here’s how it works from both a company’s and an investor’s perspective.

For a Company: A Step-by-Step Implementation Framework

- Conduct a Materiality Assessment: This is the crucial first step. Identify which ESG issues are most significant (“material”) to your business and your stakeholders. An issue material to a tech company (data privacy) will differ from one material to a mining company (water usage).

- Set Goals and KPIs: Based on the materiality assessment, set specific, measurable, and time-bound goals. For example: “Reduce Scope 1 and 2 emissions by 50% by 2030” or “Achieve gender parity in leadership roles by 2027.”

- Integrate into Strategy and Operations: ESG cannot be a side project for the PR department. It must be embedded into core business strategy, supply chain management, and product development.

- Collect Data and Report: Establish systems to collect reliable data on your ESG KPIs. Report this information publicly using established frameworks like the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB).

- Engage with Stakeholders: Continuously communicate with investors, employees, customers, and communities about your ESG progress and challenges.

For an Investor: A Step-by-Step Analysis Framework

- Screening: Use ESG ratings from providers like MSCI, Sustainalytics, or Bloomberg to screen for companies that meet specific ESG criteria or to exclude laggards.

- Integration: Systematically include ESG factors into traditional financial analysis. For example, when valuing a car company, factor in the potential regulatory fines for emissions cheating or the competitive advantage of a leading electric vehicle lineup.

- Engagement (Active Ownership): As a shareholder, use your power to vote on shareholder resolutions and engage in dialogue with company management to encourage improved ESG practices.

- Impact Investing: Allocate capital specifically to projects or companies with the explicit goal of generating a measurable, positive social or environmental impact alongside a financial return.

Why ESG is Important: The Compelling Business Case

The rise of ESG is driven by a powerful, evidence-based business case.

- Risk Mitigation: Companies with strong governance are less likely to face costly scandals. Those managing environmental risks are better prepared for climate-related disruptions and regulations. This directly protects shareholder value.

- Enhanced Financial Performance: Numerous studies have shown a correlation between high ESG scores and strong financial performance, lower cost of capital, and better stock price performance over the long term.

- Attracting and Retaining Talent: Top talent, particularly younger generations, increasingly wants to work for companies that align with their values. Strong ESG performance is a powerful recruitment and retention tool.

- Building Brand Loyalty and Trust: Consumers are more informed and conscious. They are favoring brands that demonstrate social and environmental responsibility, which builds resilient, long-term customer relationships.

- Access to Capital: A vast and growing pool of capital is managed by institutional investors who are signatories to frameworks like the UN Principles for Responsible Investment (PRI). Companies with poor ESG profiles may find it harder and more expensive to attract investment. For more on building a resilient business, explore World Class Blogs – Business & Entrepreneurship.

Common Misconceptions and Criticisms

ESG is a complex and often politicized topic. It’s essential to separate fact from fiction.

- Misconception: ESG is just “woke capitalism.”

Reality: While critics use this term, the core of ESG is about pragmatic risk management and long-term value creation. It’s about identifying companies that are well-prepared for the future, not about advancing a social agenda. - Misconception: ESG means sacrificing returns.

Reality: The data increasingly suggests the opposite. By mitigating risks and identifying future opportunities, ESG-integrated portfolios have proven to be competitive with, and often outperform, traditional portfolios over the long run. - Misconception: ESG ratings are consistent and perfectly reliable.

Reality: This is a valid criticism. Different rating agencies use different methodologies and weightings, leading to divergent scores for the same company. The industry is still maturing and standardizing. - Misconception: ESG is just a PR and marketing tool for companies (“greenwashing”).

Reality: While greenwashing is a real problem, the increasing sophistication of data analysis, regulatory scrutiny, and investor due diligence is making it harder for companies to get away with superficial claims without substantive action. - Misconception: It’s only for large corporations.

Reality: SMEs may not have the resources for extensive reporting, but the core principles of good governance, fair treatment of employees, and environmental efficiency are fundamental to any successful, resilient business.

Recent Developments and a Success Story

The ESG landscape is dynamic, with several key trends emerging.

Recent Developments:

- The Rise of Regulatory Mandates: The European Union’s Sustainable Finance Disclosure Regulation (SFDR) and the US SEC’s proposed climate disclosure rules are forcing greater transparency and standardization.

- Focus on “Net Zero”: Investor coalitions, like the Net Zero Asset Managers initiative, are pushing companies to set science-based targets to decarbonize.

- The “S” in the Spotlight: The COVID-19 pandemic and social justice movements have placed a greater emphasis on worker safety, supply chain labor standards, and racial equity.

A Success Story: Ørsted

The Danish energy company, Ørsted, provides a textbook example of ESG-driven transformation. A decade ago, it was one of the most coal-intensive energy companies in Europe. Recognizing the long-term risk of fossil fuels, it embarked on a strategic pivot to become a global leader in offshore wind energy. This required massive capital investment and a complete operational overhaul. The result? Ørsted drastically reduced its emissions, future-proofed its business model against climate regulation, created immense shareholder value, and is consistently ranked as one of the world’s most sustainable companies. This demonstrates the core ESG premise: managing for the long term is a winning strategy.

Conclusion & Key Takeaways

ESG is not a passing fad. It is a profound and permanent shift in the mechanics of global capitalism. It reflects a world where intangible assets like reputation, human capital, and risk management are as valuable as physical ones. For businesses, it is a roadmap for building resilience and securing a license to operate in the 21st century. For investors, it is an essential lens for uncovering both risk and opportunity.

Key Takeaways:

- ESG is About Long-Term Value: It is a framework for identifying companies that are well-managed, resilient, and positioned for sustainable growth.

- Governance is the Bedrock: Strong governance (the “G”) is the foundation for effective management of environmental and social issues.

- Data and Transparency are Critical: The push for standardized, auditable ESG data will continue to intensify, separating leaders from laggards.

- Stakeholders are the New Shareholders: Companies must balance the interests of a wide range of stakeholders to succeed in the long term.

- The Journey is Continuous: ESG is not a checkbox but a continuous process of improvement, measurement, and engagement.

Just as we now understand that Mental Wellbeing is crucial for a healthy society, a healthy economy requires businesses that are environmentally sound, socially responsible, and well-governed. To explore how personal financial decisions intersect with these larger trends, consider this guide on Personal Finance. For more insights, browse our full Blog or reach out with questions via our Contact Us page.

Frequently Asked Questions (FAQs)

1. What is the difference between ESG and SRI?

SRI (Socially Responsible Investing) is primarily about excluding investments based on ethical values. ESG is about integrating environmental, social, and governance factors into financial analysis to manage risk and generate long-term returns.

2. How can a small business with limited resources start with ESG?

Start with a focused materiality assessment. Identify the one or two most critical ESG issues for your business (e.g., employee well-being, local community impact, energy efficiency) and set a single, achievable goal. You don’t need a full report; start with action.

3. Are ESG ratings reliable for making investment decisions?

They are a useful starting point but should not be used in isolation. Investors should dig deeper into the underlying data, understand the rating agency’s methodology, and consider conducting their own due diligence.

4. What is “greenwashing” in the context of ESG?

Greenwashing is when a company spends more time and money on marketing itself as environmentally friendly than on actually minimizing its environmental impact. It’s a deception meant to mislead consumers and investors.

5. Is ESG just for public companies?

While public companies face more scrutiny, the principles of ESG are universally applicable. Private companies benefit from improved risk management, talent attraction, and operational efficiency by adopting ESG practices, which can also make them more attractive for future acquisition or IPO.

6. How does ESG relate to the UN Sustainable Development Goals (SDGs)?

The SDGs are a global call to action on issues like poverty and climate change. Companies can use the SDGs as a framework to align their ESG strategies with the world’s most pressing challenges, creating shared value.

7. What is the biggest criticism of ESG?

Beyond being called “woke,” the most substantive criticisms are the lack of standardized data, the potential for greenwashing, and the concern that it allows asset managers to exert too much influence over corporate policy on non-financial issues.

8. Can a company be good at one ESG pillar and bad at another?

Absolutely. A company might have excellent governance and social practices but have a significant environmental footprint (or vice versa). This is why a holistic view is necessary for a true assessment.

9. What are “Scope 1, 2, and 3 emissions”?

These are categories for classifying a company’s greenhouse gas emissions. Scope 1 are direct emissions from owned sources. Scope 2 are indirect emissions from purchased electricity. Scope 3 are all other indirect emissions in a company’s value chain, which are often the largest and most difficult to measure.

10. How can an individual investor participate in ESG?

You can invest in ESG-focused mutual funds or ETFs, use online brokerage tools that provide ESG scores for stocks, and participate in proxy voting to support shareholder resolutions on ESG issues. For those building an online business with ESG principles, this E-commerce Setup Guide can be a helpful resource.