The Inflation-Adjusted Scorecard. While all three assets provided positive real returns over this volatile period, their paths and drivers were dramatically different. (Data: Bloomberg, BLS).

Introduction – The Unrelenting Search for Protection

The specter of inflation has moved from economic textbooks to grocery store receipts. As central banks worldwide navigated the post-pandemic landscape, the surge in consumer prices that began in 2021 evolved into a more stubborn, structurally embedded challenge by the mid-2020s. For the investor, this isn’t an academic concern; it’s a direct erosion of purchasing power, a silent thief of wealth held in cash and traditional bonds. The urgent question becomes: where do you turn to preserve—or even grow—your wealth when the currency itself is decaying?

This guide dissects the three most prominent claimants to the title of “ultimate inflation hedge”: Gold, the ancient standard; Silver, its industrial counterpart; and Bitcoin, the digital challenger. In my experience, proponents of each can be evangelical, often touting past performance during specific periods as definitive proof. What I’ve found is that the reality is nuanced, regime-dependent, and requires a clear understanding of how each asset theoretically responds to inflation, and more importantly, how they have actually performed in the diverse inflationary environments of the 2020s.

We will move beyond slogans like “gold is real money” or “Bitcoin is digital gold” and into the realm of data, mechanics, and practical portfolio construction. By the end, you will have a framework not to pick a single winner, but to understand which asset, or combination, might serve your specific goals in the face of the inflationary pressures defining 2026.

Background / Context: Inflation’s Many Faces

Inflation is not a monolith. The simplistic narrative of “money printing leads to higher prices” ignores critical distinctions that assets respond to differently. We must differentiate:

- Demand-Pull Inflation: Too much money chasing too few goods (e.g., post-pandemic stimulus). This can boost corporate profits and industrial demand.

- Cost-Push Inflation: Rising input costs (energy, wages, materials) squeezing margins and potentially slowing growth—a scenario known as stagflation.

- Monetary Inflation: An expansion of the money supply, which may or may not immediately translate to consumer price inflation but can fuel asset price bubbles.

- Expectations-Driven Inflation: When consumers and businesses expect future price rises, changing their behavior in a self-fulfilling cycle.

The period of 2021-2025 provided a live laboratory of all these types. The initial demand-pull surge gave way to persistent cost-push pressures from re-shored supply chains and the green energy transition, all set against a backdrop of high government debt and evolving monetary policy. A 2026 report from the International Monetary Fund (IMF) noted that while headline inflation in developed markets had retreated from peaks, core inflation—stripping out food and energy—remained stubbornly 1-2 percentage points above central bank targets, indicating embedded structural pressures.

It is within this complex environment that we test our three hedges.

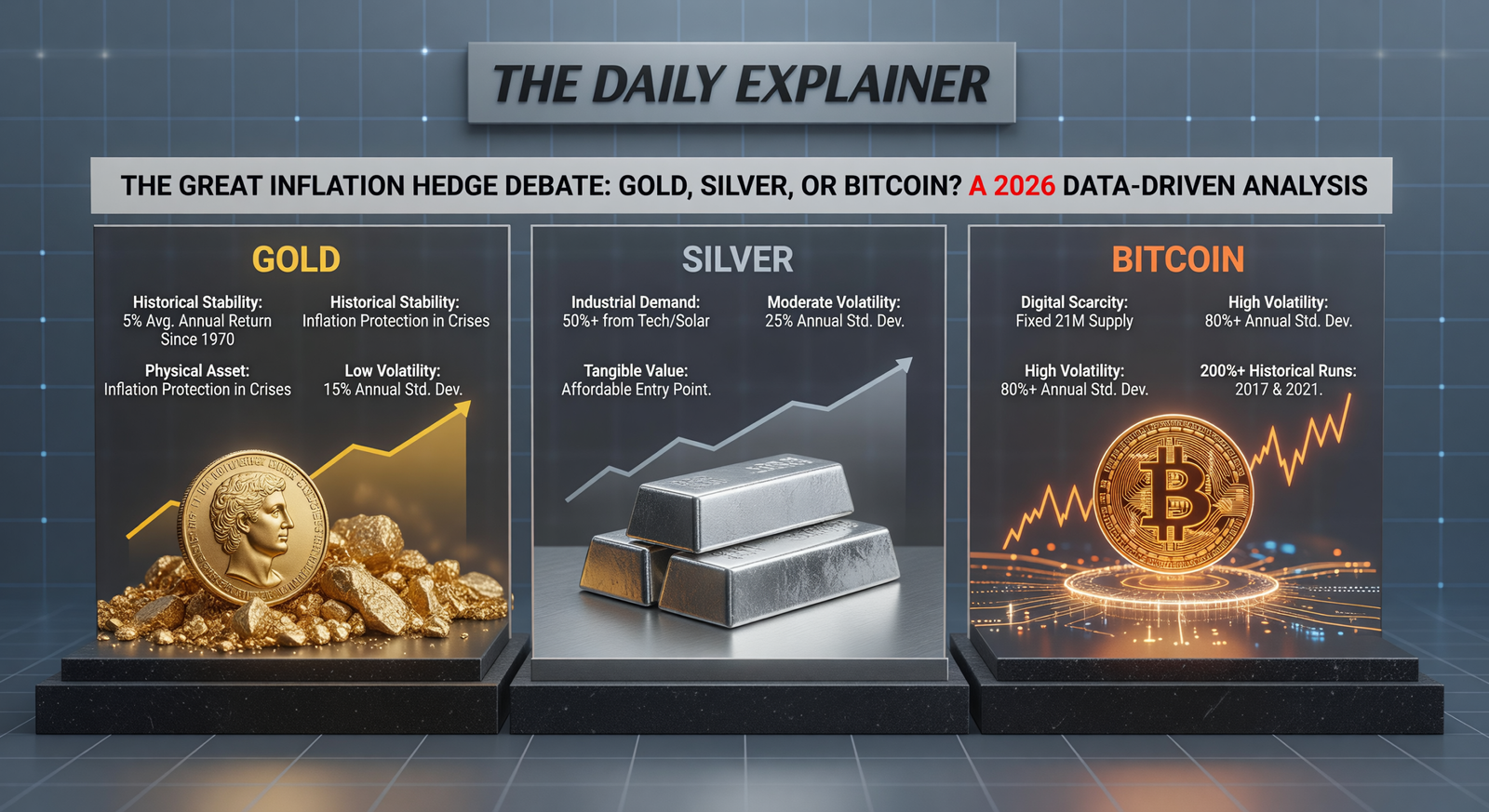

Key Takeaway: The Core Inflation-Fighting Propositions

Gold: Hedges against the debasement of currency and loss of faith in the financial system. It is a claim on monetary stability.

Silver: Hedges against inflation through its industrial utility (a real asset) and its historical monetary role. It is a claim on productive capacity.

Bitcoin: Hedges against inflation through its programmed, verifiable scarcity. It is a claim on a decentralized, predictable monetary policy.

Key Concepts Defined

- Real Returns vs. Nominal Returns: The critical distinction. A nominal return is the percentage gain in currency terms. A real return is the nominal return minus the rate of inflation. An asset only preserves wealth if its real return is positive. A 10% nominal gain with 12% inflation is a 2% loss in purchasing power.

- TIPS (Treasury Inflation-Protected Securities): The “control” in our experiment. These U.S. government bonds adjust their principal value with the Consumer Price Index (CPI), providing a direct, if imperfect, inflation linkage. Their yield shows the market’s real interest rate expectations.

- Velocity of Money: The rate at which money circulates in the economy. High velocity can amplify inflationary pressures. Bitcoin’s potential as a medium of exchange could theoretically affect this, though currently its primary use is as a store of value.

- Stock-to-Flow (S2F) Model: A scarcity model applied to both Bitcoin (due to halvings) and gold (due to high above-ground stocks vs. annual mine supply). It posits that high S2F ratios correlate with high market valuations as a store of value. Silver has a much lower S2F.

- Contango & Backwardation (for commodities): The shape of the futures curve. Persistent contango (future prices higher than spot) creates a headwind for futures-based ETFs, as they must repeatedly sell cheap near-term contracts to buy more expensive longer-dated ones—a cost called “roll yield.” This is irrelevant for physical holders but crucial when comparing ETF performance.

How It Works: A Step-by-Step Analysis of Each Hedge

Step 1: The Theoretical Mechanism – How Each Should Work

- Gold: The theory is straightforward: gold is priced in a depreciating currency (e.g., USD), so it should take more units of that currency to buy the same ounce. Its finite supply and historical role as money make it a natural refuge. It’s a pure monetary hedge.

- Silver: Operates on a dual track. Its monetary heritage suggests it should track gold. Its industrial demand (over 50% of total) means it benefits from inflationary capital expenditure—companies spending on solar panels, 5G infrastructure, and electric vehicles, the very projects spurred by a “build-out” response to economic challenges.

- Bitcoin: Its hedge is based on its algorithmic scarcity (capped at 21 million coins) versus the potentially infinite expansion of fiat currency. It’s a bet that code-enforced discipline is superior to human-managed central banking. Additionally, as a global, borderless asset, it can hedge against currency-specific inflation in countries like Nigeria or Turkey, where local investors have been major buyers.

Step 2: The Historical Stress Test – 2021-2025 Performance

Let’s examine the most recent, relevant inflationary period. The table below tracks performance from the inflation inflection point (Q1 2021) through the subsequent volatility.

| Asset / Metric | 2021 (Inflation Launch) | 2022 (Peak Inflation + Rate Hikes) | 2023-2024 (Sticky Inflation) | 2025 (Moderating Inflation) | Real Return (Cumulative ’21-’25) |

|---|---|---|---|---|---|

| U.S. CPI (Annual Avg.) | +4.7% | +8.0% | +4.5% | +3.2% | (Benchmark) |

| Gold (Spot, USD) | -3.6% | -0.3% | +13.2% | +9.8% | ~+12% |

| Silver (Spot, USD) | -11.7% | -2.7% | +19.5% | +14.1% | ~+10% |

| Bitcoin (Spot, USD) | +59.8% | -64.5% | +155%* | +48%* | ~+120% |

| S&P 500 (Total Return) | +28.7% | -18.1% | +26.3% | +16.5% | ~+45% |

| 10-Year TIPS Yield (Real Yield) | -1.0% | +1.5% | +1.8% | +2.0% | (Cost of hedge) |

*Note: Bitcoin’s 2023-2025 figures include the seismic impact of the ETF approvals. Data sourced from Bloomberg, World Gold Council, FRED.*

Analysis: The story is not linear.

- 2021: Bitcoin and stocks soared on liquidity; gold and silver lagged, contradicting the inflation narrative. This highlights that liquidity and risk appetite can trump inflation fears in the short term.

- 2022: Rising real interest rates (positive TIPS yields) were a powerful headwind for all non-yielding assets. Gold held remarkably steady; silver and Bitcoin fell sharply.

- 2023-2025: As inflation became “sticky” and the market anticipated a pause in rate hikes, gold began its climb. Bitcoin’s explosion was driven by the structural ETF inflow, a different catalyst. Silver’s strong performance reflected both catching up to gold and robust industrial demand.

Personal Anecdote: In early 2022, I held a core position in gold and a small Bitcoin allocation. As the Fed hiked rates aggressively, my Bitcoin position was crushed, while gold was flat. I used the discipline of rebalancing: I sold a small amount of gold (which had held its value) to buy more Bitcoin at a much lower price in late 2022. This wasn’t market timing; it was enforcing a pre-set allocation. That rebalanced Bitcoin position then participated fully in the 2023-2024 rally, turning a paper loss into the portfolio’s best performer.

Step 3: The Regime Filter – Which Hedge for Which Environment?

Not all inflation is created equal. Your allocation should tilt based on the dominant characteristic.

| Inflation Type | Best Hedge | Rationale & Data Point |

|---|---|---|

| Runaway / Hyperinflation (Loss of faith in currency) | 1. Bitcoin, 2. Gold | In currency collapses (Turkey, Argentina), locals flock to both. Bitcoin’s ease of cross-border movement gives it an edge for capital flight. |

| Stagflation (High inflation + Low growth) | 1. Gold, 2. Silver | Gold’s 1970s performance is legendary. Silver’s industrial side suffers from low growth, but its monetary side can benefit. Bitcoin struggles with high real rates. |

| “Greenflation” (Inflation driven by energy transition) | 1. Silver, 2. Bitcoin | Silver is a direct physical input. Bitcoin, if mined with stranded renewable energy, can be framed as a beneficiary of energy market dislocation. |

| Inflation caused by Excessive Debt Monetization | 1. Gold, 2. Bitcoin | Both are direct hedges against central bank balance sheet expansion and currency debasement narratives. |

Step 4: Implementation & The Crucial Role of Real Yields

The single most important macroeconomic variable for gold and Bitcoin is the 10-Year Treasury Inflation-Protected Securities (TIPS) Yield, or the real interest rate.

- When real yields are rising (as in 2022), the opportunity cost of holding a non-yielding asset like gold or Bitcoin increases. This is a strong headwind.

- When real yields are falling or negative, these assets become much more attractive.

Therefore, a key step in your process is to monitor the 10-Year TIPS yield. A sustained breakout above 2.5% (as seen in late 2023) is a caution flag for the gold/Bitcoin inflation hedge thesis in the near term. A drop towards or below 0% is a strong tailwind.

Why It’s Important: Beyond Preservation to Opportunity

Treating inflation hedges solely as defensive bunkers misses half their potential. In certain regimes, they become primary engines of growth. The 1970s were a lost decade for stocks but a phenomenal one for gold and commodities. The 2020-2024 period saw Bitcoin dramatically outpace other assets.

A properly structured hedge does two things:

- Protects the Downside: It reduces the real-term drawdown of your overall portfolio during inflationary shocks.

- Provides Asymmetric Upside: It offers exposure to scenarios where traditional assets (stocks/bonds) are struggling, turning a period of broad economic difficulty into one of relative or even absolute portfolio growth.

A 2025 analysis by research firm Absolute Strategy found that a portfolio with a 15% allocation split between gold and Bitcoin (and 85% in traditional 60/40 stocks/bonds) would have not only reduced volatility over the prior decade but also increased absolute returns by nearly 2% per annum, thanks to the uncorrelated spikes in the alternative assets.

Sustainability in the Future: The ESG and Digital Overlay

The future of these hedges is intertwined with environmental and technological trends.

- Gold’s ESG Challenge: Mining faces scrutiny. The response is a shift toward recycled gold, which now accounts for about 30% of annual supply, and certified responsible mining. An “ESG-premium” or “ESG-discount” is becoming a factor in mining stock valuations.

- Silver’s Green Mandate: Its role in photovoltaics and EVs aligns it powerfully with global sustainability goals. This creates a long-term, policy-driven demand floor that is inherently inflationary-resistant, as governments will subsidize these technologies regardless of economic cycles.

- Bitcoin’s Energy Evolution: The “digital gold” narrative now competes with the “digital energy commodity” narrative. Bitcoin miners are becoming agile buyers of intermittent renewable power, helping to finance and stabilize green grids. This could morph Bitcoin from being seen as an environmental pariah to a key player in the energy transition, fundamentally altering its inflation-hedge profile to include “energy scarcity.”

Furthermore, the rise of tokenized real-world assets (RWAs) on blockchains could create hybrid instruments—think a digital token representing ownership in a pool of sustainably sourced, vaulted silver. This would merge the inflation-resistant properties of the physical commodity with the divisibility and transferability of the digital asset.

Common Misconceptions

- “Gold always goes up with inflation.” Historically, it performs best with high and rising inflation, particularly when accompanied by negative real interest rates. During moderate, well-anchored inflation with positive real rates (the 1980s-2000s), gold can stagnate for decades.

- “Bitcoin is a perfect inflation hedge because it’s scarce.” Scarcity is a necessary but not sufficient condition. Market perception, liquidity, regulatory environment, and competition from other assets (like high-yielding bonds) all influence price. Its volatility also makes it a poor short-term transactional hedge.

- “Silver will outperform gold in inflation because it’s cheaper/industrial.” This depends entirely on the type of inflation. In stagflation, industrial demand craters, and silver can severely underperform gold (as in 1974-1975 and 2008).

- “Just buy TIPS for a pure inflation hedge.” TIPS protect against CPI-measured inflation, but they are still a sovereign bond carrying interest rate and counterparty risk. They protect nominal principal but offer no real growth potential and can lose value in a rising real yield environment.

Recent Developments (2024-2026)

- Debt Monetization Fears Resurface: With U.S. government debt-to-GDP exceeding 130% and deficits remaining high, markets in 2025 began pricing a higher probability of the Fed eventually monetizing debt—a direct catalyst for gold and Bitcoin.

- Bitcoin ETFs Change the Game: The ~$150 billion in inflows to U.S. Spot Bitcoin ETFs (as of Q1 2026) created a massive, sticky new demand source. This has arguably begun to decouple Bitcoin’s short-term price action from macro drivers like inflation, tying it more to its own adoption cycle, much like a growth tech stock.

- Central Banks Diversify into Gold…and Explore CBDCs: Record central bank gold buying continues, validating its monetary role. Simultaneously, their exploration of Central Bank Digital Currencies (CBDCs) creates a fascinating dynamic: CBDCs could make financial systems more efficient but also more controllable, potentially driving demand for decentralized alternatives like Bitcoin as a freedom hedge alongside the inflation hedge.

- Silver’s Physical Squeeze: The multi-year structural deficit has drawn down reported exchange inventories (COMEX) to levels not seen since 2008. This physical tightness underpins the price and makes it more sensitive to any inflationary spur in industrial demand.

Success Stories & Real-Life Examples

Case Study: The Turkish Lira Crisis (2021-2026). This provides a real-world, hyper-inflationary lab. As the Turkish Lira (TRY) lost over 80% of its value against the USD from 2021-2025, local investors sought refuge.

- Gold (in TRY): Soared over 1,200%, preserving wealth.

- Bitcoin (in TRY): Soared over 3,000%, though with gut-wrenching volatility.

- Silver (in TRY): Rose approximately 950%, lagging gold.

The key insight: Both gold and Bitcoin worked, but Bitcoin’s higher volatility meant greater potential gains (and risks) for those who could stomach the ride. Many Turks used Bitcoin not just as a store of value, but as a bridge currency to move wealth into more stable assets abroad, a utility gold couldn’t provide.

Real-Life Example: The “Stagflation Lite” Portfolio of 2023. An investor, fearing persistent inflation and slowing growth, allocated in January 2023:

- 7% to Physical Gold ETFs (IAU)

- 3% to a Silver Miners ETF (SIL) – a leveraged play on silver prices without storage

- 2% to a Bitcoin ETF (IBIT)

- 88% to a diversified portfolio of value stocks and short-duration bonds.

By December 2024, the 12% alternative sleeve had returned +42%, driven by strong performances in gold (+25%) and Bitcoin (+150%), while the silver miners were flat. The overall portfolio outperformed a pure 60/40 stock/bond portfolio by over 8%, demonstrating the hedge’s dual role of protection and growth during that specific regime.

Conclusion and Key Takeaways

The quest for the perfect inflation hedge is a fool’s errand because inflation itself is a shape-shifting adversary. Gold, silver, and Bitcoin are not rivals but specialized tools in a financial toolkit.

Your Actionable Blueprint:

- Define the Inflation You Fear: Is it currency collapse (Gold/Bitcoin), a 1970s-style stagflation (Gold), or a green energy-driven commodity boom (Silver)? Your personal risk assessment dictates your primary hedge.

- Use Gold as Your Core Stabilizer: For most investors, gold should form the bedrock of the inflation-hedging allocation due to its historical proof, lower volatility, and strong performance during systemic stress.

- Add Silver for Cyclical Kick and Green Exposure: Treat silver as a satellite holding that provides higher beta and direct exposure to the industrial/energy transition theme. It complements but does not replace gold.

- Allocate to Bitcoin for Asymmetric Potential and Digital Optionality: Size this position according to your risk tolerance and conviction in the digital future. View it as a venture-capital-like bet on a new monetary paradigm that also carries inflation-hedge properties.

- Never Set and Forget: Monitor the 10-Year TIPS Yield. Rising real yields are a headwind for gold and Bitcoin. Use rebalancing to enforce discipline—sell portions of your winners to buy more of the laggards within your alternative asset sleeve.

- Think in Real Terms, Not Nominal: Always evaluate performance net of inflation. A 5% gold return in a 7% inflation year is a loss. The goal is preservation and growth of purchasing power.

In the tumultuous economic landscape of 2026 and beyond, a rigid allegiance to one asset is a vulnerability. A dynamic, informed allocation across this powerful trinity is your strongest defense—and your most promising offense—against the enduring threat of inflation.

Frequently Asked Questions (FAQs)

1. Q: If I had to pick only ONE of these as an inflation hedge for the next 10 years, which should it be?

A: For the sole purpose of inflation hedging with minimal volatility and maximum historical precedent, gold is the singular choice. It has the longest track record across the widest variety of inflationary environments. Bitcoin is still proving itself, and silver’s industrial dependence introduces an unrelated risk. Gold’s role as a non-correlated, monetary asset makes it the most reliable core.

2. Q: How do I actually calculate the “real return” of my gold or Bitcoin investment?

A: Use this simple formula for a given period:Real Return = [(1 + Nominal Return) / (1 + Inflation Rate)] - 1

*Example: Your gold investment gained 10% (Nominal Return = 0.10). Inflation for that period was 6% (Inflation Rate = 0.06).*Real Return = [(1.10) / (1.06)] - 1 = 1.0377 - 1 = 0.0377 or 3.77%

So, your real, inflation-adjusted gain was 3.77%.

3. Q: Can’t I just buy stocks of companies that can raise prices (like consumer staples) as an inflation hedge?

A: This is a common equity-centric hedge. It can work, but it carries equity market risk. During the 2022 inflation spike, many such companies saw margins compressed by rising costs faster than they could raise prices, and their stock prices fell with the broader market. They are not a pure or uncorrelated hedge. They are a bet on specific corporate execution within an inflationary environment, which is a different proposition.

4. Q: What about real estate? Isn’t it the classic inflation hedge?

A: Real estate, especially with fixed-rate debt, can be an excellent long-term hedge. However, it is illiquid, costly to maintain, and local. It also behaves poorly when inflation is fought with rapidly rising interest rates, as in 2022-2023, when mortgage costs soared and prices corrected. It’s a powerful tool but operates in a different asset class with its own unique risks and cycles.

5. Q: How does the performance of these hedges in the US compare to their performance in other countries with high inflation?

A: In countries with high local currency inflation, the performance of gold and Bitcoin denominated in that local currency is almost always spectacular, as shown in Turkey, Argentina, and Nigeria. This is because you are hedging against a specific currency’s collapse. For a US investor, you are hedging against USD inflation, which is typically more moderate. The hedge’s “effectiveness” can appear much stronger in a failing currency environment.

6. Q: What is the impact of inflation on the mining companies themselves? Doesn’t that hurt gold and silver stocks?

A: Yes, this is a critical nuance. Inflation drives up a miner’s costs (energy, labor, steel). For the hedge to work via mining stocks, the increase in the metal price must outpace the increase in the All-In Sustaining Costs (AISC). In the early stages of inflation, costs can rise faster than prices, squeezing margins. This is why physical metal or broad ETFs (GLD, SLV) are often cleaner inflation hedges than mining stocks.

7. Q: Is there an optimal percentage of my portfolio to allocate to these inflation hedges?

A: There’s no universal optimum, but common ranges are 5-15% of a total portfolio for the combined alternative asset sleeve (which could include these plus others like commodities or managed futures). Within that sleeve, a starting point for a moderate investor could be 60% Gold, 25% Silver, 15% Bitcoin. This should be adjusted based on your personal conviction and risk assessment from the earlier steps.

8. Q: How do I manage the extreme volatility of Bitcoin within this hedging strategy?

A: You manage it through position sizing and rebalancing. If Bitcoin is only 2-3% of your total portfolio, even a 50% drop only causes a 1-1.5% overall portfolio drawdown—painful but not catastrophic. The rebalancing discipline then forces you to buy more after such a drop if your allocation falls below target, which can improve long-term returns.

9. Q: What happens if we get deflation instead? Are these assets terrible to hold?

A: In a demand-driven deflation (like the Great Depression), gold typically performs very well because it is a default store of value when other assets and currencies are failing. Cash and long-term government bonds are the classic deflation winners. Silver suffers due to crushed industrial demand. Bitcoin is untested in a major deflationary environment; it could be sold off violently as a “risk asset,” or it could be embraced as the hardest, most predictable form of money. Its outcome is highly uncertain.

10. Q: Should I use futures/options on these assets for my hedge instead of owning them directly?

A: This is an advanced strategy. Futures can provide direct exposure without storage but involve leverage, margin calls, and the contango/roll yield cost. Options (like long-dated call options) can be a cost-effective way to gain asymmetric exposure with defined risk. However, for a core, long-term hedging position, direct physical ownership (or physically-backed ETFs for gold/silver) is simpler and carries no expiry or leverage risk.

11. Q: How does the increasing adoption of Central Bank Digital Currencies (CBDCs) affect these inflation hedges?

A: CBDCs could be a double-edged sword. If they are designed as a seamless, efficient digital form of existing fiat, they might not change the inflation dynamic. However, if they enable unprecedented monetary policy (like programmability, expiration, or negative interest rates applied directly to wallets), they could dramatically increase demand for uncensorable, non-programmable assets like physical gold and decentralized Bitcoin as escape valves. They could make the inflation hedge thesis for these assets even stronger.

12. Q: What’s the single most important chart I should look at every quarter to assess the inflation hedging environment?

A: The 10-Year Breakeven Inflation Rate vs. the 10-Year TIPS Yield. The breakeven rate (derived from Treasury vs. TIPS yields) shows market inflation expectations. The TIPS yield shows the real rate. Put them side-by-side. If inflation expectations are rising and real yields are stable or falling, it’s a golden environment for gold/Bitcoin. If real yields are rising faster than inflation expectations, it’s a headwind.

13. Q: Can inflation be high while these assets go down? How is that possible?

A: Absolutely. This is the “2022 Scenario.” Inflation was high, but the primary driver of asset prices was the rapid rise in real interest rates engineered by the Fed to fight that inflation. The opportunity cost of holding a zero-yield asset became too high, causing outflows. The hedge only works if the market perceives the asset as a superior alternative to cash. If cash (via bonds) is offering a high real yield, it becomes a compelling competitor.

14. Q: Is it better to buy these hedges before inflation appears or after it has started?

A: Ideally, before, as prices will have already moved by the time inflation is headline news. However, trying to time this is exceedingly difficult. This is why a small, permanent strategic allocation is the most prudent approach. You always have some exposure. You can then make tactical additions when your analysis of macro conditions (e.g., negative real yields, excessive money supply growth) suggests the inflation hedge’s time is coming.

15. Q: How do I factor in global demand, like from Indian gold buyers or Chinese silver industry?

A: These are crucial fundamental drivers. Indian gold demand is seasonal (wedding season) and price-sensitive. Chinese industrial demand for silver in PV manufacturing is a secular trend. You don’t need to track daily imports, but be aware of major shifts. For example, a major new solar subsidy in China or India removing a gold import duty can be significant catalysts that reinforce the long-term investment case.

16. Q: What about other cryptocurrencies like Ethereum? Can they act as inflation hedges?

A: Ethereum and other “altcoins” have different value propositions (smart contracts, utility). Their supply is not as rigidly capped as Bitcoin’s (Ethereum has a variable, net-negative issuance since its upgrade). Therefore, their price is more tied to network usage and “tech stock” narratives than a pure monetary scarcity narrative. They are not reliable inflation hedges in the way Bitcoin aims to be; they are speculative investments in blockchain technology with higher beta.

17. Q: If the US government re-instated some form of gold standard, what would happen?

A: This is a low-probability but high-impact scenario. The price of gold would be revalued massively upwards to cover the outstanding money supply, potentially in the range of $10,000-$20,000+ per ounce. Existing gold holders would see extraordinary gains. Bitcoin would likely also soar as the event would represent a catastrophic loss of faith in pure fiat management, boosting the case for non-sovereign money.

18. Q: How do storage/security costs for physical metals impact their real return as a hedge?

A: They are a direct drag, analogous to the expense ratio of an ETF. If you pay 0.5% per year for vaulting and insurance, that comes directly out of your real return. This is a key reason many opt for low-cost, physically-backed ETFs for the core of their holding, reserving physical possession for a smaller, “catastrophe” portion of their allocation.

19. Q: Can I use these assets in my retirement account (IRA/401k)?

A: Gold and Silver: Yes, through a Self-Directed IRA that allows investment in IRS-approved bullion or coins, which must be stored with an approved custodian.

Bitcoin: As of 2026, while you cannot directly hold Bitcoin in a mainstream 401k, you can hold Bitcoin ETFs (like IBIT, GBTC) in many standard IRA and brokerage accounts. Some specialized Self-Directed IRA providers also allow direct ownership of cryptocurrency.

20. Q: What’s the biggest behavioral mistake people make when using these as inflation hedges?

A: Abandoning the strategy after a period of underperformance. If you buy gold because you fear inflation, and then for two years inflation is high but gold is flat (because real yields are rising), the instinct is to sell it as “broken.” This is often the wrong move. You must understand why it’s not working in that moment. If the reason is transient (aggressive central bank hiking), holding or even adding to the position as rates peak can be the correct, albeit difficult, discipline.

About the Author

Sana Ullah Kakar is a macroeconomic researcher and the principal of [Firm Name], an independent investment research firm. With a background in both classical economics and monetary history, he has spent the last decade analyzing the interplay between fiat currency regimes, commodity cycles, and emergent digital assets. His research is focused on providing investors with non-consensus, actionable frameworks for preserving capital in an era of unprecedented monetary experimentation. He writes regularly to demystify complex financial relationships for a broad audience.

Free Resources

- Inflation Hedge Calculator Tool: A downloadable spreadsheet where you input your country’s inflation data and the performance of gold, silver, and Bitcoin to automatically calculate and chart their real returns over any time period.

- Macro Regime Dashboard Template: A simple, one-page template to track the key indicators discussed: 10-Year TIPS Yield, Breakeven Inflation Rate, Gold-Silver Ratio, and Bitcoin Dominance.

- “The Inflationary Playbook” Checklist: A step-by-step checklist to follow when you believe inflationary risks are rising, covering what to analyze and how to adjust your portfolio.

- Further Reading on Global Economics: For deeper dives into the political and policy forces shaping inflation, explore our partners’ work on global affairs and policy.

Discussion

The inflation debate is charged with emotion and ideology. Let’s ground it in analysis.

- Looking at the 2026 data, which type of inflation do you believe is most likely in the next 3-5 years: stagflation, “greenflation,” or a return to moderate, controlled inflation? How does that shape your allocation between these three assets?

- Has your personal experience with the cost of living changed your view on what a “good” inflation hedge is?

- For those who hold both gold and Bitcoin: During periods when one is severely underperforming, how do you fight the urge to abandon the laggard?

- Do you believe the concept of “digital scarcity” (Bitcoin) will ever be as universally accepted a hedge as “physical scarcity” (gold), or will it always be a niche, tech-forward belief?

Share your perspectives, data points, and questions below. The collective scrutiny of informed individuals is the best defense against financial dogma and the surest path to resilient wealth-building.

Disclaimer: The information contained in this article is for educational and informational purposes only and should not be construed as professional financial, investment, or tax advice. The author may have positions in the assets discussed. The future performance of any asset cannot be guaranteed. You should always conduct your own research and consult with a qualified financial advisor before making any investment decisions