Figure 3: Matching the Asset to the System Failure. Your crisis tools should cover a range of potential breakdowns, from loss of digital infrastructure to loss of trust in financial intermediaries.

Introduction: The Ultimate Litmus Test

Financial markets in calm weather are poor predictors of true asset character. It is during the storm—when confidence evaporates, liquidity vanishes, and systemic cracks appear—that an asset’s fundamental nature is revealed. For the modern investor holding gold, silver, and Bitcoin, understanding how this trinity behaves under extreme stress is not academic; it is essential for risk management and survival.

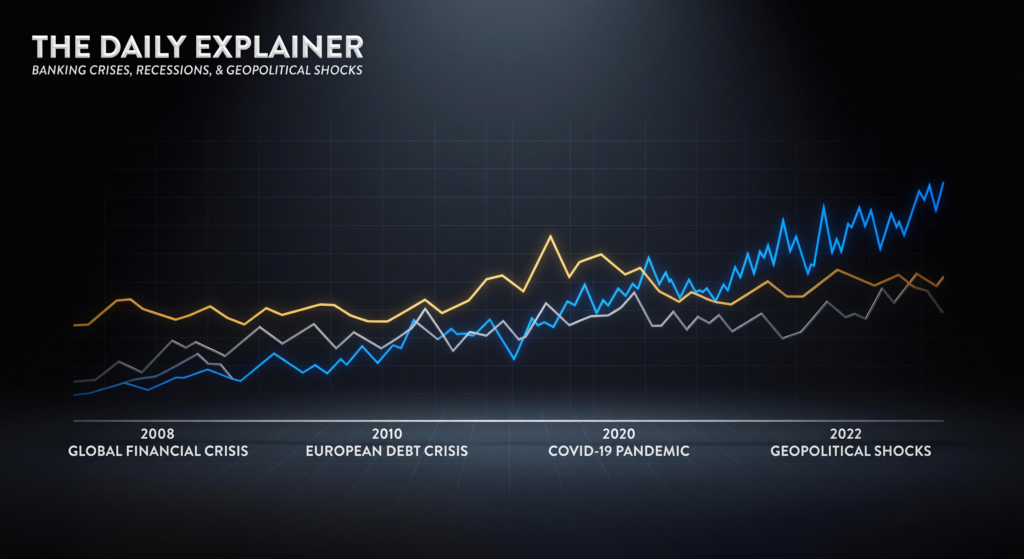

This article is a forensic stress test. We will analyze historical and recent crises—from the 2008 Global Financial Crisis and the 2020 COVID crash to the 2023 Regional Banking Stress and the ongoing geopolitical fractures of the mid-2020s—to map the performance and psychology of each asset. In my experience advising clients through these events, the theoretical “store of value” narrative often shatters against the hard reality of panic-driven liquidity flows. What I’ve found is that their behaviors are not monolithic; they are regime-specific, telling a story of fear, utility, and the search for a functioning system.

We will move beyond platitudes like “gold is a safe haven” to ask: Which kind of safe haven? For which specific fear? By the end of this analysis, you will have a crisis playbook: a clear understanding of what to expect from each part of your portfolio when the next systemic shock hits, enabling you to hold with conviction or act with clarity.

Background / Context: The Anatomy of a Crisis

Not all crises are alike. To predict asset performance, we must first diagnose the crisis type:

- Liquidity/Financial Crisis (e.g., 2008, 2023 Bank Runs): A seizure in the credit and banking system. Trust between financial institutions evaporates. The primary fear is counterparty risk and insolvency.

- Economic Crisis/Recession (e.g., 2020 COVID, 2001 Dot-com bust): A sharp contraction in economic activity, corporate earnings, and employment. The primary fear is loss of income and deflationary collapse.

- Geopolitical Shock (e.g., 2022 Ukraine Invasion, 2024 Taiwan Strait tensions): Armed conflict, trade embargoes, or threats that disrupt supply chains and sow uncertainty. The primary fear is supply disruption, inflation, and sovereign risk.

- Monetary/Currency Crisis (e.g., 1997 Asian Financial Crisis, ongoing Turkish Lira collapse): A rapid devaluation of a sovereign currency or loss of faith in a central bank. The primary fear is the destruction of purchasing power in a specific currency.

In the interconnected world of 2026, crises often blend these types. The 2022-2024 period was a masterclass in this: a geopolitical shock (Ukraine) triggered a cost-push inflation crisis, which led to aggressive monetary tightening, which then precipitated a liquidity crisis in regional banks. We will see how each asset navigated this compound stressor.

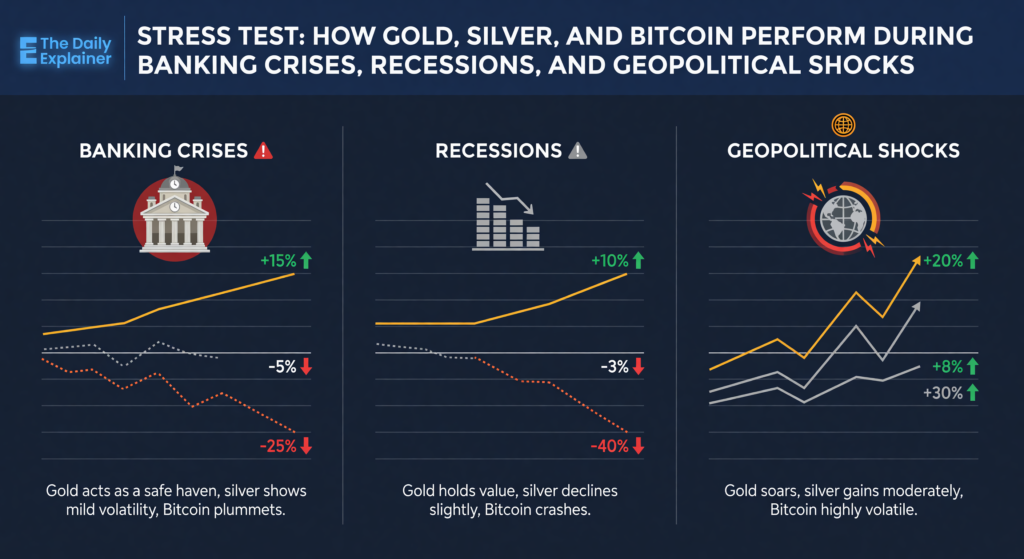

Key Takeaway: The Crisis Response Matrix

Gold’s Prime Function: Hedge against Financial System Risk and Currency Debasement. Performs best when trust in banks or fiat money fails.

Silver’s Dual Nature: Industrial Commodity first in a pure recession; Monetary Metal secondarily during inflation-driven or systemic crises.

Bitcoin’s Evolving Role: From Risk-On Tech Asset (sold for liquidity) to Alternative System Asset (bought as a bank alternative). Its role is changing rapidly.

Key Concepts Defined

- Flight-to-Quality (or Flight-to-Safety): The rapid movement of capital into the most secure, liquid assets during panic—traditionally U.S. Treasuries, the U.S. dollar, and to a significant extent, gold. The key is perceived safety and liquidity.

- Liquidity Crunch: A period where selling begets more selling because there are no buyers. Even fundamentally sound assets can crash. This is the environment where correlations between disparate assets often converge to 1 (they all go down together) as investors sell what they can to raise cash.

- Safe Haven vs. Hedge: A safe haven asset is expected to retain or increase value during market stress. A hedge is an asset that moves inversely to another. Gold can be both. Bitcoin is still proving its safe haven credentials.

- Network Effect Under Stress: For Bitcoin, a crisis tests its core value proposition: a decentralized, censorship-resistant network. Does the network stay up? Can transactions settle? The answer so far has been yes, reinforcing its reliability.

- Contagion: The spread of a crisis from one institution, sector, or country to others. This often triggers the second, more severe wave of asset price moves.

How It Works: A Step-by-Step Analysis of Crisis Performance

Step 1: The Liquidity/Financial Crisis Playbook (2023 Regional Banking Case Study)

Event: In March 2023, the sudden failures of Silicon Valley Bank (SVB) and Signature Bank in the U.S., followed by Credit Suisse’s forced sale, triggered fears of a broader banking crisis.

- Week 1 (Bank Run Fear):

- Gold: +6.5%. Classic flight-to-safety. Investors sought the ultimate non-bank, non-counterparty asset.

- Silver: +3.2%. Followed gold’s coattails but with less conviction.

- Bitcoin: +40%. This was the defining moment. Capital did not flee from Bitcoin; it fled to Bitcoin as the “bank outside the banking system.” The narrative shifted from “risk asset” to “alternative settlement network.”

- Week 2-4 (Government Backstop & Calm):

- Gold gave back half its gains as FDIC guarantees and Fed lending facilities restored calm.

- Bitcoin retained most of its gains, settling ~25% higher, suggesting a permanent re-rating based on its proven utility during bank stress.

Verdict: In a pure banking system crisis, Bitcoin may now be the highest-beta performer, with gold as the stable anchor. Silver is a follower.

Step 2: The Economic Crisis/Recession Playbook (2020 COVID Crash Case Study)

Event: In Q1 2020, global lockdowns triggered the fastest equity bear market in history on fears of a depression.

- Phase 1: Liquidity Panic (Feb-Mar 2020):

- Everything was sold. The S&P 500 dropped ~34%. Gold initially dropped ~12%. Silver crashed ~38%. Bitcoin plummeted ~53% in 24 hours on March 12 (“Black Thursday”). This was the liquidity crunch in its purest form. Correlations converged to 1. Investors sold anything with a bid to raise dollar cash.

- Phase 2: Policy Response & Recovery (Mar-Onward):

- Once the Fed unleashed unlimited QE and fiscal stimulus was announced, the reflation trade began.

- Gold recovered swiftly and rallied to new all-time highs by August 2020, a hedge against the coming monetary inflation.

- Bitcoin recovered even more dramatically, beginning its bull run to $65k.

- Silver, leveraged to both monetary and industrial hope, staged the most explosive rally, nearly doubling from its lows by August.

Verdict: In a sharp, deflationary economic shock, expect an initial liquidity-driven selloff in all three. Their recovery trajectory and speed will then be determined by the policy response. Gold recovers first on safety, then Bitcoin and silver on reflation hopes.

Step 3: The Geopolitical Shock Playbook (2022 Ukraine Invasion Case Study)

Event: Russia’s invasion of Ukraine in February 2022 created a shock to energy, food, and industrial metal supplies.

- Initial Reaction (Invasion Day +1 Week):

- Gold: +8%. Classic geopolitical hedge.

- Silver: +6%. Followed gold; its industrial role in defense/electronics may have provided a small premium.

- Bitcoin: -5%. Treated as a risk asset, sold off. However, it also became a vital tool for moving value across borders for affected populations, demonstrating utility under sanctions.

- Secondary Effect (Weeks 2-8: Sanctions & Inflation Fears):

- Gold and silver consolidated then pushed higher as the conflict fueled global inflation.

- Bitcoin recovered its losses and traded sideways, caught between its risk-asset correlation and its emerging “sanctions-proof” narrative.

Verdict: In a geopolitical shock, gold is the clear and immediate winner. Bitcoin’s performance is ambiguous and depends on whether the event triggers broader risk-off sentiment or highlights its unique censorship-resistant attributes.

Step 4: The Monetary/Currency Crisis Playbook (Ongoing Debasement & 2025 Emerging Market Stress)

Event: Not a single event, but a trend. Persistent high inflation in Western economies in 2022-2024 eroded real wages. Simultaneously, currencies in Turkey, Argentina, Egypt, and Nigeria experienced severe devaluation.

- In Developed Markets (Inflation Hedge):

- Gold performed well in nominal terms but struggled in real terms during periods of sharply rising real interest rates (2022).

- Bitcoin was crushed in 2022 by rising rates but soared in 2023-2024 as inflation became “sticky” and the ETF narrative took over.

- In Emerging Markets (Currency Collapse):

- Local currency prices for gold and Bitcoin went parabolic. In Turkey, from 2021-2025, gold in TRY is up ~1,200%, Bitcoin in TRY is up ~3,000%.

- Here, Bitcoin’s advantage is portability and borderlessness. A Turkish citizen could convert savings to Bitcoin and, if needed, move that value to a German exchange for euros far more easily than smuggling gold.

Verdict: In a currency crisis, both gold and Bitcoin are effective hedges, with Bitcoin offering superior ease of transport and access to a global liquidity pool. Silver is less effective due to its bulk and lower monetary premium.

Personal Anecdote: During the 2023 banking stress, a client with a large deposit at a regional bank (not SVB) called in a panic. We had established a 5% allocation to physical gold and a 2% allocation to Bitcoin in cold storage years prior. My advice was: “Do nothing. Your exposure to that bank’s failure is limited to your uninsured cash. You already own significant assets outside that very banking system. That’s why we bought them.” The psychological relief was immediate and tangible. The allocation served its purpose before the crisis even hit.

Why It’s Important: Beyond Returns to Functional Utility

Stress testing reveals more than price action; it reveals functional utility. In a crisis, an asset is not just a number on a screen; it is a tool for solving problems.

- Gold’s Utility: A physical, non-digital claim to value that exists outside all electronic systems. Its utility peaks when digital systems or banking networks are in doubt.

- Bitcoin’s Utility: A digital, non-sovereign claim to value that can be transmitted globally without permission. Its utility peaks when the traditional gatekeepers of value (banks, governments) are the source of the problem (capital controls, sanctions, insolvency).

- Silver’s Utility: Primarily industrial. Its monetary utility is a secondary, derived function. In a crisis that crushes industrial demand (a deep recession), this is a liability.

Understanding this allows you to construct a portfolio not just for returns, but for operational resilience. You are hedging against different types of system failure.

Sustainability in the Future: Crises in a Digital and Fractured World

Future crises will have new dimensions that favor digital assets:

- Cyber-Warfare & Grid Attacks: An attack on financial market infrastructure or the power grid would cripple digital trading but also electronic gold ETF settlements. Physical gold’s utility would soar, but so might Bitcoin’s if its network (supported by a globally distributed miner network) remained operational while traditional banking rails were down.

- CBDC-Enabled Financial Surveillance/Control: If a crisis is met with a government using a Central Bank Digital Currency (CBDC) to impose negative rates or spending restrictions, the demand for uncensorable assets like Bitcoin and physical gold would explode. This could be the catalyst that permanently establishes Bitcoin as a safe haven for digital age sovereignty.

- Climate-Driven Disruption: A crisis caused by climate disaster could simultaneously crush industrial demand (bad for silver) and trigger massive inflationary spending on rebuilding (good for gold and Bitcoin as monetary hedges).

The assets that survive and thrive will be those that provide utility in the specific broken context of the future crisis.

Common Misconceptions

- “Gold always goes up in a crisis.” It goes up in crises that threaten the financial system or currency. It can fall initially in a deflationary liquidity crunch where the demand for cash dollars overwhelms everything (2008, 2020).

- “Bitcoin is too volatile to be a crisis hedge.” Volatility is not the same as correlation. An asset can be volatile but have a low or negative correlation to stocks during a crisis, which is the definition of a good hedge. Bitcoin’s correlation regime is shifting, as 2023 showed.

- “If the stock market crashes, everything crashes.” This is only true in the initial, violent liquidity phase (which may last days or weeks). After that, divergence occurs. In 2008, after the initial fall, gold rallied over 25% from Nov 2008 to Feb 2009 while stocks continued to make new lows. This divergence is where hedging pays off.

- “In a real war, you’d want bullets, not Bitcoin.” This conflates short-term survival with medium-term wealth preservation. In the acute phase of a conflict, yes, essentials matter. But for the 99.9% of crises that are financial or geopolitical rather than existential, maintaining the ability to preserve and transfer capital is paramount.

Recent Developments (2024-2026)

- Bitcoin’s “Safe Haven” Credit Strengthens: The 2023 banking crisis response was not a fluke. During the 2025 debt ceiling brinkmanship in the U.S., which threatened a technical default, Bitcoin significantly outperformed both gold and the S&P 500 in the weeks leading up to the deadline, suggesting the market is now pricing it as a hedge against sovereign credit risk.

- Gold’s Central Bank Backstop Solidifies: Record central bank buying (1,100+ tonnes annually) has created a massive, price-insensitive buyer of last resort. This puts a formidable price floor under gold during any future crisis, making deep sell-offs less likely.

- Silver’s Green Tech Link Becomes a Double-Edged Sword: A crisis caused by an energy shortage could simultaneously boost silver’s monetary appeal (inflation hedge) and crush its industrial demand (solar panel manufacturing halts). Its path would be highly uncertain.

- Correlation Data Evolution: Analysis from Goldman Sachs’ 2026 Commodity Report shows the 90-day correlation between Bitcoin and the S&P 500 has declined from an average of ~0.45 in 2021 to ~0.25 in 2025, while its correlation with gold has risen from ~0.1 to ~0.3. This data confirms Bitcoin is decoupling from “risk-on” and modestly coupling with “monetary hedge” assets.

Success Stories & Real-Life Examples

Case Study: The Lebanese Banking Collapse (2019-Ongoing). This is a real-time laboratory for a total domestic financial system failure. Citizens were locked out of their dollar-denominated bank accounts (capital controls).

- Those who held physical gold or dollars at home preserved wealth but faced security risks and could not easily move value abroad.

- Those who held Bitcoin could convert local currency savings to Bitcoin via peer-to-peer exchanges and, crucially, send that value to relatives abroad or secure it in a digital wallet untouched by Lebanese banks. Bitcoin didn’t just store value; it enabled capital flight and family remittances when the traditional system failed completely. Its utility was transformative.

Real-Life Example: The “Sanctions Hedge” of 2022-2024. Following sanctions on Russia, many Russian citizens and entities turned to alternative channels. While gold was bulky and traceable, Bitcoin and other cryptocurrencies became a reported, though difficult-to-quantify, tool for moving value. This demonstrated a new crisis utility: bypassing sanctioned traditional financial networks. This utility ensures demand for Bitcoin in future geopolitical fractures, regardless of its short-term price correlation with stocks.

Conclusion and Key Takeaways: Building the Crisis-Resistant Portfolio

The goal is not to predict the next crisis but to be prepared for its many forms. Your portfolio should contain tools for different emergencies.

Your Crisis Preparedness Blueprint:

- Hold Physical Gold for “System-Off” Scenarios: Allocate a portion of your gold to physical coins or bars in your direct, secure possession. This is your hedge for a digital grid failure, banking holiday, or hyperinflation where electronic claims are frozen.

- Hold Bitcoin for “Gatekeeper Failure” Scenarios: Maintain a self-custodied Bitcoin holding (hardware wallet). This is your hedge against bank insolvency, capital controls, or sovereign overreach via CBDCs. It’s your escape hatch from the traditional financial system.

- Use Gold & Bitcoin ETFs for Liquidity and Rebalancing: Hold traded versions (ETFs) of both assets to provide liquidity, allow for easy rebalancing, and capture gains during crises that don’t involve electronic market failure.

- Understand Silver’s Role is Economic, Not Systemic: Size your silver allocation with the knowledge it will behave poorly in a deflationary recession and may initially lag in a pure financial panic. Its strength is in the recovery and reflation phase after a crisis.

- Have a Crisis Liquidity Plan: Know the order in which you would liquidate assets. Typically: 1) Cash, 2) Bond ETFs, 3) Gold/Silver/Bitcoin ETFs, 4) Physical holdings (last resort). This prevents panic selling of your core hedges at the worst time.

In the end, the most valuable asset during a crisis is not gold, silver, or Bitcoin—it is knowledge and preparation. By understanding how these assets have historically behaved, you can construct a portfolio that doesn’t just survive the next storm, but uses it to emerge stronger. The stress test is not pass/fail; it’s a continual process of adaptation. In 2026, with systems more complex and intertwined than ever, that adaptation requires a blend of the oldest and newest forms of money.

Frequently Asked Questions (FAQs)

1. Q: In a major crisis, won’t governments just seize gold and ban Bitcoin?

A: Gold Confiscation: Historical (1933 U.S.) precedent exists but targeted monetary gold (large bars), not small personal holdings. It’s a low-probability, high-impact risk. Mitigation: geographic diversification of storage.

Bitcoin Ban: A ban is more likely than physical seizure, but its effectiveness is dubious. Bitcoin is a global network; a ban in one country would reduce local liquidity but not kill it. A coordinated global ban is logistically and politically near-impossible. The 2021 China ban is a case study: mining moved, trading went offshore, and the network persisted.

2. Q: If there’s a cyber attack on the power grid, how would I access my Bitcoin?

A: This is a critical vulnerability for digital assets. Bitcoin requires an internet connection and power for you to sign and broadcast a transaction. However, the Bitcoin network itself is incredibly resilient, powered by a globally distributed network of miners. Your personal access is the weak link. Solutions include having a hardware wallet that can be powered by a battery pack and knowing a location (perhaps with a trusted relative in another region) with stable power, where you could access your keys. This scenario strongly argues for also holding physical gold.

3. Q: During the 2020 crash, everything crashed together. Doesn’t that make diversification pointless?

A: The initial liquidity phase (a few weeks) saw high correlation. This is the “portfolio margin call” effect. However, diversification is about the recovery path, not the bottom. After March 2020, gold, Bitcoin, and silver recovered and soared while many equities sectors lagged for years. Diversification ensured you had assets that participated in the recovery, not just the crash. It protects the medium-term portfolio, not necessarily the instantaneous portfolio value at the panic low.

4. Q: Should I hold more gold or more Bitcoin for a potential U.S. debt crisis?

A: A U.S. debt crisis (default or severe loss of confidence) would likely see capital rush into both as “non-sovereign” assets. However, their paths might differ:

- Gold would benefit from a collapse in the U.S. dollar and a flight to tangible assets.

- Bitcoin would benefit from a loss of faith in U.S. financial management and a search for an algorithmic, politically-neutral alternative.

A balanced position in both is prudent. Historically, gold is the proven responder to sovereign debt fears. Bitcoin is the new, high-beta candidate.

5. Q: What about simply holding cash (USD) in a crisis? Isn’t that the safest?

A: Cash (physical dollars) is an excellent short-term liquidity tool during a banking crisis or for immediate needs. However, it is a terrible long-term crisis hedge if the crisis involves inflation or currency devaluation. In hyperinflation, cash becomes wallpaper. Your strategy should include a layer of physical cash for immediate emergencies, but your core crisis holdings should be in assets that protect against the debasement of that cash.

6. Q: How do I safely store physical gold if I’m worried about societal breakdown?

A: This enters the realm of security, not just finance. Principles include: secrecy (tell no one), dispersion (don’t keep it all in one place), secure hardware (a high-quality safe bolted to the structure), and geographic diversification (some in a deposit box or vault in another stable jurisdiction). The cost and hassle are why physical gold is only for a portion of your allocation.

7. Q: If a crisis causes a market “circuit breaker” or trading halt, can I still trade my Bitcoin?

A: Yes, with a major caveat. Bitcoin markets trade 24/7 on global, decentralized exchanges. If the NYSE halts, Bitcoin trading continues. However, if your access is through a U.S.-regulated Bitcoin ETF (like IBIT), that ETF will be halted if U.S. equity markets are halted. This is a crucial distinction: Self-custodied Bitcoin on a global exchange offers continuous liquidity. A Bitcoin ETF does not. This argues for having some direct Bitcoin exposure outside the traditional market structure.

8. Q: Does the performance of mining stocks (GDX, SIL) mirror the metals during crises?

A: No, they are far more volatile and correlate more with equities. In 2008, gold fell ~10% at the worst point, but gold mining stocks (GDX) fell over 60%. They are leveraged plays on the metal price but carry operational, financial, and equity market risk. For pure crisis hedging, the physical metal or a physically-backed ETF is cleaner.

9. Q: What is the impact of rising interest rates (like in 2022) on these crisis hedges?

A: Rising rates, especially real rates, are the kryptonite for non-yielding assets. In 2022, the crisis was caused by inflation itself, and the remedy (hiking rates) directly hurt gold and Bitcoin. This is a nuanced point: they hedge against the consequences of inflation (currency debasement), but can suffer from the cure (higher rates). In such a crisis, they may not perform well initially. Their performance would come later, if the rate hikes trigger a different crisis (recession, banking stress).

10. Q: How can I simulate or back-test a portfolio for these crisis scenarios?

A: Use portfolio tools like Portfolio Visualizer and focus on specific crisis periods. Set the date range to, for example, August 2007 – March 2009 (GFC), or February 2020 – June 2020 (COVID). Input your proposed allocation (e.g., SPY for stocks, GLD for gold, a Bitcoin proxy like a tech index pre-2014). Analyze not just total return, but maximum drawdown and the monthly returns to see the sequence of pain and recovery.

11. Q: Are there “crisis indicators” I can watch to know when to increase these allocations?

A: Leading indicators are imperfect, but watch:

- TED Spread: Difference between 3-month LIBOR (or SOFR) and 3-month T-bills. A widening spread indicates rising interbank lending fear.

- Credit Default Swap (CDS) spreads for major banks.

- Volatility Index (VIX): A sustained high VIX indicates fear.

- Google Trends for “bank run” or “safe haven.”

A tactical increase in gold/Bitcoin when these indicators spike from a low base can be prudent, but a strategic core holding is more reliable than timing.

12. Q: What happens in a crisis if the internet is severely degraded but not fully offline?

A: Bitcoin’s Lightning Network (a second-layer payment protocol) is designed for resilience, but it depends on nodes being online. If internet becomes slow and unreliable, Bitcoin transactions may become expensive and slow to confirm, but the ledger would remain secure. This scenario would likely see a premium placed on settled, confirmed Bitcoin held in cold storage (already on the blockchain) and a massive premium on physical gold. It reinforces the need for both.

13. Q: How do custodial risks change during a crisis? (e.g., my ETF custodian or crypto exchange fails)

A: Risk increases exponentially. In 2022, the crypto exchange FTX failed, wiping out custodial holdings. In a 2008-style crisis, even major bank custodians could be at risk. Mitigation:

- For Gold: Use fully allocated, segregated storage where your specific bars are identified and you have legal title.

- For Bitcoin: Self-custody the majority. Use regulated, reputable custodians (Coinbase Institutional, Fidelity) only for trading amounts.

- For ETFs: Understand they are unsecured claims on a fund. Diversify across fund families (don’t hold only GLD).

14. Q: In a war scenario, isn’t it better to hold assets in a neutral country like Switzerland?

A: Geographic diversification is a key principle of crisis prep. Holding gold in a Swiss vault or using a Swiss bank account to buy ETFs can provide shelter from your home country’s specific risks. Similarly, Bitcoin’s location is your private key, which can be memorized or stored physically anywhere. The principle is: Don’t keep all your assets within one legal or geographic jurisdiction.

15. Q: What’s the minimum amount of physical gold or Bitcoin I should hold for it to be meaningful in a crisis?

A: There’s no fixed amount, but think in terms of essential coverage. Enough to:

- Physical Gold: Cover several months of critical living expenses if cash systems are down.

- Bitcoin: Enough to facilitate a major life change if needed (e.g., fund an international move, pay a ransom, access capital if local banks are closed). For many, this could be a holding worth 1-5% of their total liquid net worth in physical/direct form.

16. Q: How do estate planning and inheritance work for these assets in a crisis?

A: This is often overlooked. For physical gold, your heirs must know the location and access method. Document this securely with your will/attorney.

For Bitcoin, they must have access to your seed phrase or hardware wallet. Use a multi-signature setup requiring keys held by multiple trusted parties, or a digital inheritance service like Casa’s. Practice is crucial; a crisis is the worst time to explain this.

17. Q: Could a crisis cause a “break” in the Bitcoin blockchain, making it worthless?

A: A break (a permanent fork where consensus is lost) is the existential risk. It’s considered extremely low probability due to the enormous economic value securing the chain. More likely is temporary network congestion during high stress, leading to high transaction fees. The network’s 17-year history of uninterrupted operation is its best credential.

18. Q: What about using options on GLD or Bitcoin ETFs as a cheaper crisis hedge?

A: Buying long-dated out-of-the-money call options on GLD or a Bitcoin ETF can be a cost-effective way to gain asymmetric exposure to a crisis spike. You risk only the premium. However, options expire—you must be right on timing. For a permanent, strategic hedge, owning the asset is superior. Options are a tactical overlay.

19. Q: How did Platinum and Palladium perform in these crises? Should I consider them?

A: Platinum and Palladium are almost purely industrial metals (auto catalysts). They perform terribly in recessions and offer little monetary hedge. They are not substitutes for gold/silver in a crisis portfolio. They belong in a commodity sleeve, not a monetary resilience sleeve.

20. Q: What is the single most important psychological tip for holding through a crisis?

A: Have a written plan you review in calm times. It should state: “If X crisis happens, I will do Y. I will not sell my gold/Bitcoin below Z price or before Condition A is met.” During a panic, your prefrontal cortex shuts down. You will operate on emotion and instinct. A pre-written, signed plan is your anchor to rationality.

About the Author

Sana Ullah Kakar is a crisis portfolio manager and the founder of [Firm Name], which specializes in building and stress-testing resilient investment strategies for high-net-worth families. With a background in risk management at a major global bank during the 2008 crisis, he has a firsthand understanding of how liquidity vanishes and correlations break. He has spent the last decade modeling tail-risk scenarios and practical asset deployment. His writing aims to replace fear with framework, giving investors the tools to not just endure chaos, but to navigate it with purpose.

Free Resources

- Crisis Response Flowchart: A one-page decision tree for different crisis types (Banking Panic, Recession, Geopolitical Shock) recommending specific actions for your gold, silver, and Bitcoin holdings.

- Historical Crisis Performance Datasheet: A downloadable spreadsheet with the monthly returns of gold, silver, Bitcoin, and the S&P 500 during 2008, 2020, 2022, and 2023 events.

- Personal Security & Storage Audit Checklist: A non-alarming guide to reviewing the physical and digital security of your alternative asset holdings.

- “The Family Conversation” Guide: A script for discussing crisis preparedness with family members without causing undue alarm.

- Further Analysis on Global Stress: For deeper understanding of the systemic pressures that create crises, explore content on global affairs and policy.

Discussion

Crisis planning is sobering but empowering.

- Based on the current geopolitical and economic landscape of 2026, which type of crisis do you think is most probable in the next 3 years, and how has that influenced your allocation between gold, silver, and Bitcoin?

- For those who lived through 2008 or 2020: What did you learn about your own risk tolerance and the behavior of these assets that changed your strategy?

- How much of your “crisis holding” is about financial utility versus psychological comfort? Is there a difference?

- What single question about crisis performance are you still worried about that this guide didn’t address?

Share your scenarios, your preparations, and your unresolved fears. In preparing for the worst, we often build our best defense: a community of informed and thoughtful individuals.

Disclaimer: This article discusses extreme scenarios and is for educational purposes only. It is not a guarantee of future performance or safety. All investments carry risk, including total loss. Crisis scenarios can lead to unpredictable government actions, market closures, and asset seizures that no model can fully capture. You should consult with security, legal, and financial professionals to develop a plan suited to your specific circumstances.