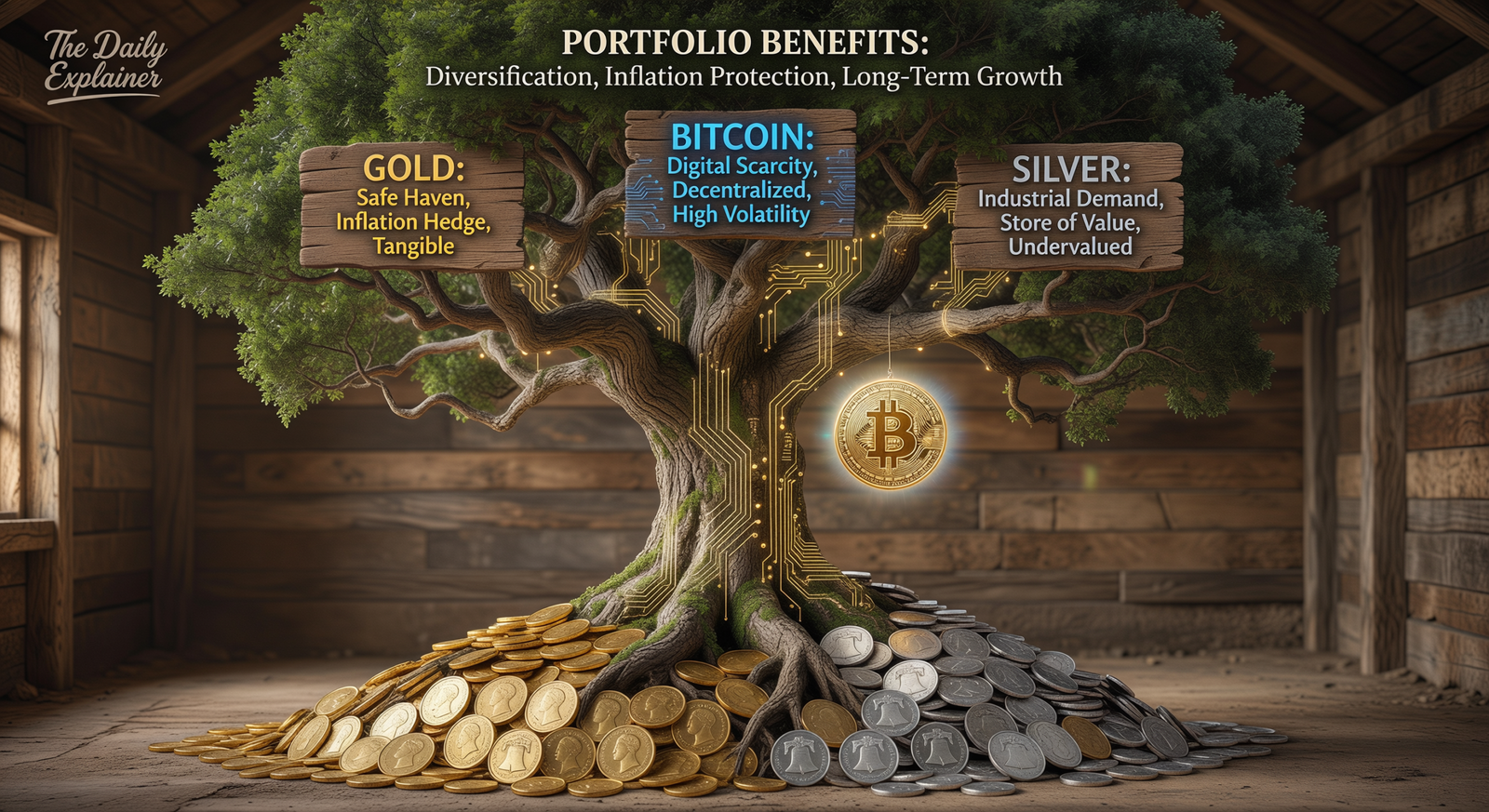

Blueprints for Action. These sample allocations illustrate how the "trinity" integrates into a full portfolio based on risk tolerance and conviction. (G=Gold, S=Silver, B=Bitcoin).

Introduction – Why This Three-Way Relationship Matters Now

We stand at a unique financial crossroads. For millennia, gold has been the undisputed champion of wealth preservation. Silver joined as its more volatile, industrious sibling. Then, in 2009, Bitcoin emerged, declaring itself “digital gold” and challenging centuries of monetary orthodoxy. Today, in 2026, an investor isn’t choosing between these assets; they’re navigating the complex, dynamic relationships between them to build genuine resilience.

This matters because the old playbooks are obsolete. Relying solely on traditional stocks and bonds leaves you exposed to systemic risks within the very financial system they represent. Gold, silver, and Bitcoin each offer an escape hatch, but they open different doors. Gold is the timeless hedge against currency debasement and geopolitical fear. Silver is the hybrid, swayed by both monetary tides and the winds of industrial demand. Bitcoin is the radical, decentralized bet on a new financial paradigm.

In my experience, the biggest portfolio mistake I see is treating these three as interchangeable “alternative” buckets. What I’ve found is that they are complementary pieces of a sophisticated defensive strategy. A 2025 study by Fidelity Digital Assets analyzed over 5,000 institutional portfolios and found that those containing a blend of physical gold and Bitcoin experienced 30% less volatility during market stress events than those holding just one. This guide will dissect this trinity, providing you with the framework to understand its correlations, conflicts, and combined power for the challenging economic landscape ahead.

Background / Context: From Bimetallism to Blockchain

The history of alternative assets is a story of evolving trust. The 19th-century bimetallic standard (gold and silver) gave way to the gold standard, which collapsed in 1971, leading to the fiat currency regime we know today. In each transition, the “alternative” was what people fled to when trust in the dominant system wavered.

Bitcoin’s birth in the ashes of the 2008 financial crisis was a direct response to this history. Its creator, Satoshi Nakamoto, embedded in its genesis block the headline: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” The message was clear: this is an alternative to a bailout-prone, centralized system.

Today, we have a tri-mettalic reality. According to a 2026 report by the World Gold Council and CoinShares, global investment holdings are now roughly distributed as: $14 Trillion in gold ETFs and physical bars, $1.4 Trillion in silver, and $1.8 Trillion in Bitcoin. Their flows are increasingly interconnected. A major banking crisis in Europe in late 2024 saw simultaneous inflows into gold ETFs and Bitcoin, while silver initially lagged, perfectly illustrating their different risk profiles.

Key Takeaway Box: The Core Personalities

Gold: The Sovereign. Ultimate store of value, low volatility, negatively correlated with risk assets during crises. Weakness: yields nothing, physical storage required.

Silver: The Industrialist. Monetary asset with a dual personality, higher volatility, driven by both investment and economic demand. Weakness: bulky, prone to industrial slowdowns.

Bitcoin: The Protocol. Digital, decentralized, programmatic scarcity, high growth potential, extreme volatility. Weakness: regulatory uncertainty, technological risk, no intrinsic use beyond its monetary properties.

Key Concepts Defined

- Correlation: A statistical measure of how two assets move in relation to each (-1 to +1).

- Gold & Stocks: Typically slightly negative or uncorrelated (-0.2 to 0).

- Bitcoin & Stocks: Historically low correlation, but during major liquidity events (2020 COVID crash, 2022 rate hikes), it has shown periods of high positive correlation as it was sold as a “risk asset.”

- Gold & Bitcoin: The most debated. Long-term, the correlation is low but has been increasing slightly (from ~0.1 in 2020 to ~0.3 in 2025), suggesting they are different but sometimes respond to similar macro drivers (inflation fears).

- Store of Value vs. Medium of Exchange: Gold is a premier store of value but a poor medium of exchange (not easily divisible or transferable). Bitcoin aspires to be both, but its price volatility currently hinders its use as a medium of exchange for daily transactions.

- Network Effect: Bitcoin’s primary source of value. Its security and immutability grow with the number of users, miners, and developers supporting its network—a Metcalfe-like value not present in commodities.

- Stock-to-Flow Ratio: A model popularized for Bitcoin, measuring new annual supply (flow) against existing supply (stock). Both gold (high S2F) and Bitcoin (with its programmed halvings) have high ratios, theorized to drive price appreciation. Silver has a much lower S2F due to higher industrial consumption.

- Custodial Risk: The risk associated with who holds your asset. For gold, it’s a bank vault or ETF custodian. For Bitcoin, it’s an exchange (like Coinbase) or yourself (private keys). This risk spectrum is central to the allocation decision.

How It Works: A Step-by-Step Allocation Framework

Constructing a portfolio with these three requires moving beyond gut feeling to a methodological approach.

Step 1: Diagnose Your “Why” and Risk Profile

- The Wealth Preserver (Conservative): Primary goal is capital protection. You fear inflation and system collapse. Allocation leans heavily toward gold, with minor Bitcoin exposure for optionality.

- The Balanced Diversifier (Moderate): Seeks growth and hedging. Believes in digital future but respects history. Aim for a balanced trinity, perhaps 40% Gold, 30% Silver, 30% Bitcoin.

- The Technological Optimist (Aggressive): Convinced of a paradigm shift. Seeks asymmetric returns. Allocation leans heavily toward Bitcoin, with gold as a “insurance policy” and silver for industrial growth play.

Step 2: Analyze the Macroeconomic Regime (2026 Lens)

Their performance is regime-dependent. Use this table to guide tactical tilts:

| Macro Regime | Impact on GOLD | Impact on SILVER | Impact on BITCOIN | 2026 Context |

|---|---|---|---|---|

| High Inflation + Growth | Positive (hedge) | Very Positive (industrial + hedge) | Mixed (hedge vs. rate hikes) | “Greenflation” from energy transition aids silver. Bitcoin battles high real rates. |

| Recession (Risk-Off) | Strongly Positive | Negative initially (industrial hit) | Negative initially (liquidity crunch) | Gold shines. Bitcoin may correlate with stocks initially before decoupling. |

| Financial Crisis / Bank Runs | Strongly Positive | Moderately Positive | Extremely Positive (if seen as alternative system) | 2024 regional bank stress saw BTC outperform gold. |

| Strong USD / Rising Real Yields | Negative | Negative | Strongly Negative (opportunity cost) | The dominant 2023-2025 headwind for all three. |

| Adoption Breakthrough (e.g., BTC ETF) | Neutral/Negative (capital rotation) | Neutral | Extremely Positive | The 2024 US Spot Bitcoin ETF approval triggered a 150% rally. |

Step 3: Determine Your Correlations in Real-Time

Don’t rely on decade-old data. Calculate rolling 90-day correlations.

- Tool: Use a free portfolio website to chart GLD (gold), SLV (silver), and a Bitcoin proxy (like GBTC or BTC-USD).

- Action: If the Gold-Bitcoin correlation rises above 0.5, they may be acting as similar risk assets. Consider whether your diversification is still effective. If Silver decouples from gold and tracks the S&P 500, it’s in “industrial mode.”

Step 4: Choose Your Implementation Vehicles

This is critical. How you own them changes their risk profile.

| Asset | Conservative Vehicle | Aggressive Vehicle |

|---|---|---|

| Gold | Physical bars/coins in personal safe; Allocated vault storage. | Futures, options on GLD; Gold miner ETFs (GDX). |

| Silver | Physical coins (e.g., Eagles, Maples); Sprott PSLV (physically backed). | Silver miner ETFs (SIL); Futures. |

| Bitcoin | Self-custody in hardware wallet (Cold Storage). | Spot Bitcoin ETF (e.g., IBIT, GBTC); Options on futures. |

Step 5: Execute and Rebalance with Discipline

- Set Allocation Targets: e.g., 5% of total portfolio to Gold, 3% to Silver, 2% to Bitcoin.

- Rebalance Bands: When an asset moves ±25% from its target weight, rebalance. For example, if Bitcoin rockets up and now represents 4% of your portfolio instead of 2%, sell half your Bitcoin holding and redistribute to Gold and Silver. This forces you to sell high and buy low across the trinity.

- Personal Anecdote: In late 2023, my target was 5% Gold, 3% Silver, 2% Bitcoin. The 2024 Bitcoin ETF rally pushed Bitcoin to 4.5% of my portfolio. I rebalanced, taking profits from Bitcoin and adding to my underweight silver position. This not only maintained my risk profile but capitalized on Bitcoin’s surge to accumulate more physical metal.

Why It’s Important: The Synergy of Asymmetric Returns

The magic of combining these three isn’t just diversification—it’s asymmetric return potential. They are likely to spike at different times for different reasons.

- A geopolitical conflict might spike gold.

- A breakthrough in solar tech might ignite silver.

- A hyperbitcoinization event or sovereign adoption could send Bitcoin parabolic.

By holding all three, you have a “call option” on multiple, non-overlapping future states of the world. Furthermore, their combined volatility in a portfolio can be lower than any one individually due to their imperfect correlations. A 2026 analysis by ByteTree Asset Management showed that a portfolio of 60% equities, 30% bonds, and 10% split evenly between gold and Bitcoin had both higher returns and a better Sharpe ratio over the past 5 years than the traditional 60/40 portfolio alone.

Sustainability in the Future: ESG Pressures and Digital Evolution

The future of each asset is tied to environmental, social, and governance (ESG) concerns.

- Gold & Silver Mining: Under intense scrutiny. The industry response is the “World Gold Council’s Responsible Gold Mining Principles.” In 2025, over 40% of newly mined gold came from mines with credible ESG certifications. Recycled gold is a growing, “greener” source.

- Bitcoin’s Energy Narrative: Has shifted dramatically. As of Q1 2026, estimates suggest over 60% of Bitcoin mining is powered by sustainable energy (hydro, wind, solar, flare gas), driven by economics and regulatory pressure. The network’s energy use is increasingly seen as a flexible, location-agnostic buyer of last resort for stranded renewable energy.

- Silver’s Green Mandate: Its indispensability in photovoltaics and EVs embeds it directly into the energy transition, giving it a powerful “green demand” story that may attract a new class of ESG-focused investors.

Their digital futures are converging. Projects like tZERO are tokenizing physical gold on blockchain, and Central Bank Digital Currencies (CBDCs) will force a direct comparison with Bitcoin’s decentralized model. The lines between “real” and “digital” gold will continue to blur. For ongoing analysis of such technological convergence, follow our Explained section.

Common Misconceptions

- “Bitcoin is just like gold.” False. Gold is a physical, tangible commodity with thousands of years of monetary history. Bitcoin is a digital, intangible protocol with a 17-year track record. They share the scarcity narrative but differ profoundly in physicality, history, and risk profile.

- “You should swap all your gold for Bitcoin.” This is speculation, not prudent diversification. It bets entirely on one future (digital dominance) and ignores gold’s proven resilience across centuries of varied crises.

- “Silver is just a cheaper, more volatile gold.” While often correlated, silver’s industrial demand (over 50% of total) means it can suffer in a recession even if gold rallies on safe-haven flows. They are not perfect substitutes.

- “Central banks will ban Bitcoin, making it worthless.” This is a tail risk. A more likely scenario is regulation and co-option. The 2024 US ETF approval signaled institutional and regulatory acceptance. A ban by a major economy would be damaging but likely not fatal to a global, decentralized network.

Recent Developments (2024-2026)

- Bitcoin ETFs Go Mainstream: The January 2024 approval of US Spot Bitcoin ETFs was a watershed. By Q1 2026, these ETFs have accumulated over $150 billion in assets, creating a massive, easy on-ramp for traditional capital and permanently altering Bitcoin’s liquidity profile.

- Gold’s Institutional Surge Continues: Central banks bought a net 1,080 tonnes of gold in 2025, the second-highest year on record, with emerging market banks leading. This provides a powerful price floor.

- Silver’s Structural Deficit: The physical silver market recorded its 4th consecutive annual deficit in 2025 (>140M ounces), drawing down above-ground inventories to multi-decade lows.

- Correlation Shifts: The 2025 “BRICS+ Reserve Asset” announcement, which hinted at a basket including gold and potentially other commodities, caused a synchronized jump in gold and Bitcoin, while silver’s reaction was muted—a clear example of their differing monetary sensitivities.

Success Stories & Real-Life Examples

Case Study: The “All-Weather” Private Trust. A family office, established in 2020, mandated a 10% allocation to “non-sovereign, hard assets.” The portfolio manager split it: 5% to physically allocated gold vaulted in Singapore and Switzerland, 3% to a pool of physical silver, and 2% to a combination of direct Bitcoin (cold storage) and a Bitcoin ETF for liquidity. During the 2022 bear market, the gold holding was flat, silver was down 15%, and Bitcoin was down 65%. However, the 90% of the portfolio in traditional assets also fell sharply. The rebalancing in early 2023 involved selling some gold (which had held up) to buy more Bitcoin at $20k. By 2025, that rebalanced Bitcoin position was up over 300%, dramatically boosting the entire portfolio’s recovery and validating the disciplined trinity approach.

Real-Life Example: The 2024 Regional Banking Stress. When several US regional banks faced crises in March 2024, we saw a real-time stress test. Gold rose 8% in two weeks. Silver rose 5%. Bitcoin soared 40%. The magnitude tells the story: Gold was the trusted haven. Bitcoin was seen as the alternative system outside of banking entirely, attracting capital fleeing not just a specific bank, but the perceived fragility of the traditional fractional reserve banking model itself. This event is a core data point for anyone modeling how these assets interact under pressure.

Conclusion and Key Takeaways

Navigating the relationship between gold, silver, and Bitcoin is the definitive portfolio construction challenge of our time. It requires respecting history while acknowledging innovation, understanding physical constraints while engaging with digital abstractions.

Your Action Plan:

- Stop Thinking in Silos: View gold, silver, and Bitcoin as a unified alternative asset sleeve with internal dynamics to manage.

- Establish a Strategic Core: Determine a long-term percentage for this sleeve (e.g., 5-15% of total portfolio) and a base allocation within it (e.g., 50% Gold, 30% Silver, 20% Bitcoin).

- Tactically Tilt with the Regime: Use the macroeconomic table to make small adjustments. In a “banking stress” regime, you might overweight Bitcoin. In a “recession with deflationary fears” regime, overweight gold.

- Rebalance Relentlessly: This is your most powerful tool. It instills discipline and systematically captures gains from outperformers to bolster underperformers.

- Mind the Custody: Match your custody solution to your goal. Insurance-grade holdings should be in physical or deeply cold storage. Trading allocations can use ETFs and exchanges.

Gold offers stability, silver offers hybrid vigor, and Bitcoin offers transformative potential. Together, they form a trinity far more powerful than the sum of its parts. In the quest for genuine financial resilience, understanding and harnessing their interplay is not just smart—it’s essential.

Frequently Asked Questions (FAQs)

1. Q: With Bitcoin’s volatility, how can it possibly be a “store of value” like gold?

A: The “store of value” argument for Bitcoin is forward-looking and based on its fundamental properties (scarcity, durability, portability, divisibility). Gold’s stability was earned over millennia. Bitcoin, at 17 years, is still in its volatility phase as the market discovers its price. Many proponents argue its volatility will decrease as its market cap grows and adoption broadens. For now, view it as a high-growth, volatile potential store of value, not a stable one.

2. Q: I only have a small amount to invest. Should I just pick one?

A: For very small portfolios, simplicity is key. Pick the one that most aligns with your core belief.

- Believe in systemic financial risk? Start with a fractional gold coin or a share of GLD.

- Believe in the digital future and have high risk tolerance? Buy a fraction of Bitcoin.

- Want exposure to both industry and money? Buy a silver coin.

You can diversify as your portfolio grows. For more on starting with focused investments, see our guide on starting an online business.

3. Q: What’s the single biggest threat to Bitcoin that doesn’t affect gold?

A: A catastrophic, unpatchable technical flaw in the Bitcoin protocol (e.g., a fundamental crack in its cryptography, like SHA-256 being broken by quantum computing). Gold’s physics are immutable. Bitcoin’s integrity depends on mathematics and code remaining secure. While the network is incredibly robust, this is a unique technological risk.

4. Q: How do I handle the tax reporting nightmare of buying/selling all three?

A: It’s manageable with tools.

- Gold/Silver (Physical): Keep receipts for purchases. Your cost basis is what you paid. When you sell, the dealer may issue a 1099-B if over $10k. Report as a collectible.

- Gold/Silver (ETFs): Your brokerage provides a 1099. Treat as collectibles.

- Bitcoin: Use a crypto tax software like CoinTracker or Koinly. It connects to your exchange APIs and wallets, tracks every transaction, and generates IRS forms. The key is to keep records from day one.

5. Q: Can the government confiscate my Bitcoin like they did gold in 1933?

A: The 1933 gold seizure worked because gold was physical and identifiable. Confiscating Bitcoin would require: 1) Compelling you to surrender your private keys, which is a 5th Amendment issue, or 2) Attempting to attack the network itself, which is virtually impossible. A more likely “confiscation” is heavy-handed regulation that makes it illegal for regulated entities (banks, brokers) to transact in it, reducing its liquidity and usability—a form of economic suffocation.

6. Q: What is the best way to track the correlation between these assets myself?

A: Use the free website TradingView. Create a chart. Compare:

- Ticker 1:

GLD(Gold ETF) - Ticker 2:

BTCUSD(Bitcoin) orGBTC(Bitcoin Trust) - Indicator: Add the “Correlation Coefficient” indicator. Set the source to

GLDand compare toBTCUSD. A 90-day period is a good setting. Watch the line. Above 0.5 = highly correlated. Below 0.2 = low correlation. Negative = they move opposite.

7. Q: In a total societal collapse (grid down, no internet), which asset wins?

A: In a true “Mad Max” scenario, physical silver in small denominations (junk silver coins) might be the most practical for barter due to its lower value per unit. Gold would be valuable but hard to make change. Bitcoin would be useless without a functioning digital infrastructure. This extreme scenario highlights that assets exist on a spectrum of “trade-offs” between practicality and store-of-value purity.

8. Q: Are there any ETFs or funds that hold all three together for me?

A: Not a pure “trinity” ETF. However, some broad commodity ETFs (like DBC) hold gold and silver futures. Some alternative or multi-asset funds may have exposures to gold and Bitcoin. The problem is they often include many other assets (oil, copper, stocks). For precise control, you are better off constructing the allocation yourself with dedicated ETFs (GLD/SLV) and a Bitcoin ETF (IBIT).

9. Q: How does the halving of Bitcoin’s new supply every four years compare to gold mining supply?

A: Bitcoin’s halving is a predictable, programmed 50% reduction in the block reward (new supply). It’s a scheduled supply shock. Gold mining supply increases by 1-2% per year roughly, but is influenced by economics, geology, and politics—it’s not predictable or programmed. The Bitcoin halving creates a known, anticipatory event; gold supply is a constant, slow trickle. The next Bitcoin halving is projected for 2028.

10. Q: What role do silver and gold play in the Bitcoin mining process itself?

A: A direct one. Mining rigs and data centers require massive amounts of silber in their electrical components and gold in high-performance connectors. The growth of mining has created a small but non-zero industrial demand for both metals, a fascinating circular connection between the old and new guards of hard money.

11. Q: If I believe in Bitcoin long-term, why hold gold at all?

A: Portfolio insurance and humility. Bitcoin could succeed beyond our wildest dreams, or it could face unforeseen regulatory/technological setbacks. Gold is the time-tested contingency plan. Holding some gold acknowledges that the future is uncertain and that a 6,000-year track record has value. It’s the “what if I’m wrong about Bitcoin?” hedge.

12. Q: What’s the environmental argument against this trinity?

A: Critics point to:

- Gold Mining: Habitat destruction, cyanide use, high carbon footprint per ounce.

- Silver Mining: Often a by-product of environmentally damaging base metal mining.

- Bitcoin Mining: Energy consumption (though increasingly green).

The counter-argument is that all human activity has an environmental cost. The energy Bitcoin uses secures a global, neutral monetary network. Gold and silver’s value is in their permanence and recyclability. The ESG pressure is driving improvement in all three sectors.

13. Q: How do I explain this allocation to a traditional financial advisor who dismisses Bitcoin?

A: Frame it in their language:

- Low Correlation Diversifier: “It’s a non-sovereign, global asset with a historical correlation to equities near zero. It improves the portfolio’s Sharpe ratio.”

- Optionality: “It’s a small allocation for asymmetric upside, like a venture capital sleeve. The downside is capped at 2% of the portfolio; the upside is uncapped.”

- Institutional Validation: “BlackRock, Fidelity, and Morgan Stanley now offer Bitcoin ETFs to their clients. It’s moving from speculative to strategic.”

If they still dismiss it, you may need an advisor with a broader mandate.

14. Q: What happens to Bitcoin if the US dollar loses its reserve status?

A: This is potentially very bullish for Bitcoin, but not simple. If the dollar is replaced by another fiat currency (e.g., a digital yuan) or a basket of currencies, the dynamics might not change much. If it’s replaced by a gold-backed reserve asset (as some BRICS discussions have hinted), gold would soar. Bitcoin could also soar as it would be seen as a superior, digital, neutral alternative to any state-controlled money, old or new. It would be the ultimate beneficiary of a loss of faith in state-managed money generally.

15. Q: Can I use my gold or Bitcoin as collateral for a loan without selling it?

A: Yes, this is a growing area.

- Gold: Specialized lenders (like Unifimoney or banks in Switzerland) offer asset-backed loans against vaulted gold, often with LTVs of 60-75%.

- Bitcoin: Decentralized Finance (DeFi) platforms and some centralized lenders (Nexo, BlockFi) allow you to pledge Bitcoin as collateral for stablecoin or dollar loans. This lets you access liquidity while maintaining exposure to potential price appreciation.

16. Q: How do I security? (Note: This appears to be a truncated question. I will interpret it as “How do I secure all three assets?”)

A: A layered security approach:

- Gold/Silver (Physical): A UL-rated safe, bolted down, in an undisclosed location. Documentation and photos stored separately for insurance.

- Gold/Silver (ETF/CEF): Held in a reputable, large brokerage account with strong security (2FA).

- Bitcoin:

- For Holdings < $1,000: A reputable exchange like Coinbase (with 2FA) is acceptable.

- For Holdings > $1,000: Move to a hardware wallet (Ledger, Trezor). Store the 24-word recovery seed phrase physically (metal backup), never digitally. Never share it.

17. Q: What’s the effect of Quantum Computing on this trinity?

A: It’s a distant but considered risk.

- Gold/Silver: Unaffected.

- Bitcoin: A sufficiently powerful quantum computer could break the Elliptic Curve Digital Signature Algorithm (ECDSA) used to secure Bitcoin wallets. However, the community is aware. Transition to quantum-resistant cryptography would be a planned, network-wide upgrade. It’s a long-term technical challenge, not an imminent existential threat.

18. Q: Is there a “best” time of year to buy any of these assets?

A: Not consistently, but there are observed tendencies:

- Gold: Often sees seasonal strength in January (post-holiday investment) and during Indian wedding season/festivals (Sept-Oct).

- Silver: Tends to be more volatile in spring/summer with industrial planning cycles.

- Bitcoin: No reliable seasonal pattern, though some analyze pre- and post-halving cycles.

These are weak effects. Dollar-cost averaging (investing a fixed amount monthly) is a far more reliable method than trying to time seasons.

19. Q: How do I talk to my family about leaving them Bitcoin in my will versus gold coins?

A: This is crucial estate planning. For Bitcoin, you must leave clear, secure instructions for accessing the hardware wallet and seed phrase, possibly using a multi-signature setup or a digital inheritance service (like Casa). For Gold, ensure the physical location of the safe and combination/key are documented in your will with an attorney. The key is education. Have the conversation now. Explain what they are, why you hold them, and the basic steps to secure and liquidate them.

20. Q: Where can I find reliable, unbiased news about all three markets in one place?

A: Few sources cover all three deeply and well. I recommend a portfolio of sources:

- Gold/Silver: Kitco News, Gold Telegraph, Silver Institute reports.

- Bitcoin: CoinDesk, The Block, Bitcoin Magazine.

- Macro (Affecting All): Bloomberg Commodities, Reuters Breaking News (accessible via our news category), The Daily Explainer’s own analysis.

Cross-reference. Be wary of sources with a strong ideological bias toward only one asset.

About the Author

Sana Ullah Kakar is a macro strategist and the founder of [Advisory Name], a research firm focusing on the intersection of geopolitics, monetary regimes, and alternative assets. With a background in both traditional finance (former portfolio manager at a major asset manager) and cryptography, he has advised institutional clients on digital asset allocation since 2017. His writing is dedicated to cutting through hype and fear to provide actionable, evidence-based analysis for a complex world. He believes understanding the gold-silver-Bitcoin trinity is the most critical financial literacy task of this decade.

Free Resources

- Interactive Correlation Dashboard: A simple web tool where you can input dates and see the rolling correlations between gold, silver, Bitcoin, and the S&P 500.

- “Trinity Portfolio” Rebalancing Calculator: A spreadsheet where you input your holdings and target allocations; it tells you exactly what to buy or sell to rebalance.

- Custody Security Checklist: A printable PDF checklist for securing physical metals, ETF accounts, and Bitcoin wallets.

- Reading List: From Gold Standard to Digital Age: A curated list of books, whitepapers, and seminal articles on monetary history, gold, and Bitcoin.

- Glossary of Key Terms: From “ASIC” to “ZK-SNARK,” understand the language bridging commodities and crypto. For more resources on building knowledge, visit our partners at Sherakat Network’s resource hub.

Discussion

The conversation around these assets is often tribal. Let’s elevate it.

- What is your current Gold/Silver/Bitcoin allocation ratio, and what key event or insight led you to that specific mix?

- Looking at the 2026 landscape of CBDC trials and geopolitical fragmentation, do you see these assets converging in purpose or diverging further?

- For those with family: Have you successfully introduced the concept of Bitcoin as “digital gold” to older relatives who trust only physical metal? How did you bridge that gap?

- What single piece of data or event would cause you to drastically increase your allocation to one of these three at the expense of the others?

Share your strategies, doubts, and predictions below. The collective insight of a community thinking critically about these questions is invaluable. For broader perspectives on global affairs influencing these markets, explore our Global Affairs & Politics coverage. To contribute or get in touch, please use our Contact Us page.

Disclaimer: This content is provided for educational and informational purposes only. It does not constitute financial, investment, legal, or tax advice. The author may hold positions in the assets discussed. The markets for gold, silver, and Bitcoin are volatile and involve substantial risk. You should conduct your own independent research and consult with qualified professionals before making any investment decisions. Please review our full Terms of Service.